Since the beginning of this year, the performance of the precious metals market has captured the attention of global investors. The price of gold has repeatedly reached new highs, continuously breaking historical records, and has become a frequent headline in financial media. Another leading player in the precious metals market, silver, has exhibited even more volatile behavior.

Silver’s rise this year not only followed in the footsteps of gold but also demonstrated explosive power far surpassing that of gold. A combination of macroeconomic conditions and micro-level supply and demand dynamics is driving the upward breakout in silver prices. However, vigilance is required regarding potential rapid corrections following extreme one-sided rallies.

Where does silver’s demand come from? Precious metal allocation and industrial applications.

To deconstruct the underlying logic of this round of price movements, it is essential to focus on silver's dual nature: it benefits as a financial asset due to expectations of interest rate cuts, while also being an indispensable raw material in industrial production.

Financial resonance during the interest rate cut cycle.

The shift in monetary policy by global central banks, especially the Federal Reserve, forms the macroeconomic backdrop for the rise in precious metal prices. As the Fed enters a rate-cutting cycle, real interest rates begin to decline. This directly reduces the opportunity cost of holding non-interest-bearing assets. Capital flows out of money market funds and government bonds, seeking safe havens that preserve value and offer growth potential. Silver, as a traditional precious metal, naturally absorbs this excess liquidity.

The shift in monetary policy by global central banks, especially the Federal Reserve, forms the macroeconomic backdrop for the rise in precious metal prices. As the Fed enters a rate-cutting cycle, real interest rates begin to decline. This directly reduces the opportunity cost of holding non-interest-bearing assets. Capital flows out of money market funds and government bonds, seeking safe havens that preserve value and offer growth potential. Silver, as a traditional precious metal, naturally absorbs this excess liquidity.

An environment of monetary easing often coincides with concerns about rising inflation. Historically, silver has been regarded as an effective hedge against fiat currency depreciation. Investors buying silver are essentially hedging against credit-based currencies. When the US dollar index weakens, the dollar-denominated price of silver naturally gains upward momentum. The resurgence of this financial attribute provides solid underlying support for silver prices.

Structural surge in industrial demand.

Beyond its financial characteristics, the surge in industrial demand is the core driver behind this silver bull market. Silver possesses the highest electrical conductivity and thermal conductivity of any metal found in nature, establishing its irreplaceable role in modern industry.

Rapid advancements in photovoltaic technology are rapidly depleting global silver inventories. The evolution of solar panel technology, particularly the growing market share of N-type cells (TOPCon and HJT), has significantly increased silver consumption per watt. For example, Samsung’s transition to mass production of solid-state batteries, which aim to replace lithium-ion batteries and rely on silver as a key component, further intensifies demand. The global wave of energy transition is effectively becoming a race to secure silver resources.

The wave of artificial intelligence is also inseparable from silver. The high computational power demands of AI data centers bring significant challenges in heat dissipation and connectivity. High-performance servers, connectors, and related electronic components all require high-quality conductive materials to ensure stable signal transmission and efficient heat dissipation. The application scope of silver in electronics continues to expand with technological progress, ranging from smartphones to electric vehicles, from 5G base stations to precision medical equipment—silver is omnipresent.

Why did the price of silver suddenly surge at the end of the year?

The rigid growth in industrial demand contrasted sharply with the stagnation of mine supply. This supply-demand mismatch laid the groundwork for the sharp year-end surge in silver prices. Additionally, three specific catalysts are currently at play.

First, China's new export control policies have sparked market concerns.

China will implement a new silver export licensing system starting in January 2026. Market participants widely interpret this move as an effort to protect its silver inventories, which are critical for products like batteries and solar panels. This could imply stricter controls on future silver exports, potentially even leading to reduced export quotas.

To avoid future uncertainties, traders and downstream industrial users may begin stockpiling silver in advance. This precautionary hoarding behavior has exacerbated short-term supply-demand tensions. The concentrated influx of buying quickly drove up premiums in the spot market.

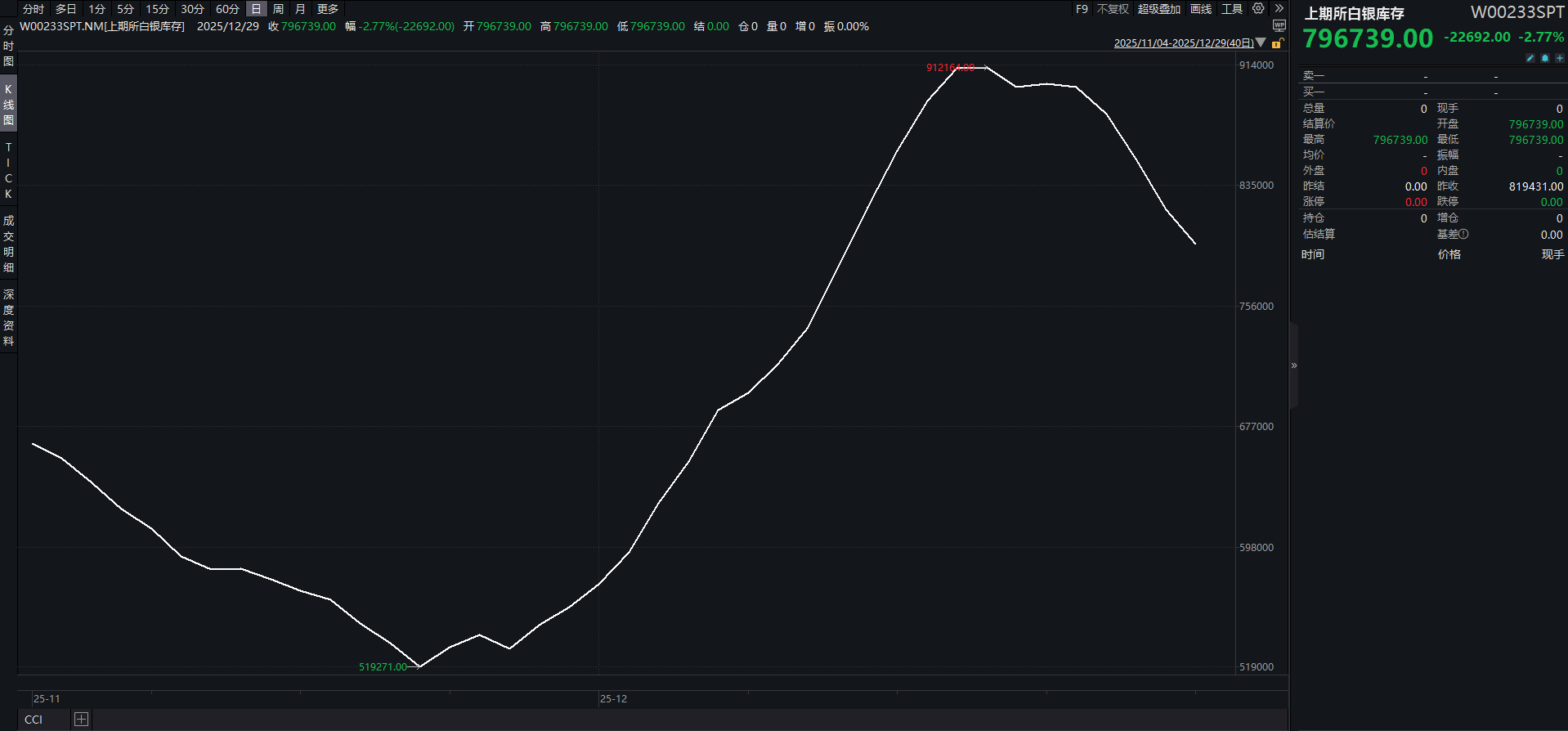

Second, the ongoing decline in global visible inventories has sounded alarm bells.

Industrial demand for silver has exceeded mining output for the fifth consecutive year. This long-term supply deficit has been offset in recent years by drawing down surface inventories.

Silver inventory data from the London Bullion Market Association (LBMA) and the Shanghai Futures Exchange (SHFE) are showing synchronized declines. The downward trend in inventories is more than just a statistical figure—it directly reflects the tightness in the physical market, indicating fewer deliverable physical silver supplies and further supporting silver's upward price movement.

Third, geopolitical tensions and national security reviews have heightened supply anxieties.

Traders are closely monitoring the moves of the U.S. Department of Commerce. The U.S. Department of Commerce is conducting an investigation under Section 232 of the Trade Expansion Act of 1962 to assess whether imports of processed critical minerals and their derivatives pose a threat to U.S. national security. On April 15, 2025, Trump signed a presidential executive order directing the Secretary of Commerce to initiate this investigation.

If silver or other related critical minerals are added to the restricted list, or if the U.S. government decides to establish a strategic reserve, this would further drain liquidity from the market. This makes silver no longer just a commodity; it is becoming a strategic resource.

Risk of Short Squeeze: A Battle Between History and Reality

The sharp vertical rise in silver prices exhibits typical characteristics of a short squeeze. Any rational investor observing such extreme price volatility must consider the potential risks. The current market dynamics evoke memories of the famous Hunt Brothers’ silver market manipulation incident.

How does this short squeeze differ from the era of the Hunt Brothers?

In 1980, the Hunt Brothers controlled a massive silver position by hoarding physical silver and purchasing futures contracts, driving prices to a historical peak of $50. While the current rally bears some resemblance to that period, the structure of the market has fundamentally changed since then.

Part of the reason for the current rally resembles a futures short squeeze—limited deliverable inventories support an oversized paper silver market. The scale of derivatives in modern financial markets far exceeds that of the 1980s. Extensive trading in paper silver (ETFs, futures, options) is based on limited physical inventory. When the physical stock cannot meet potential delivery demands, short sellers panic.

The difference now is that, besides speculators, there is also substantial industrial demand and central bank reserve needs. This means the momentum behind the short squeeze is not only driven by capital speculation but also by real supply-demand imbalances. However, the current market has been compounded by excessive speculative sentiment. The rapid spread of information on social media amplifies emotional reactions among retail investors, thereby exacerbating price fluctuations.

The Regulating Hand of Exchanges: The Impact of CME Margin Increases

As the world's largest derivatives exchange, CME Group will not stand idly by while the market experiences excessive volatility. Recently, the CME has raised margin requirements for silver futures twice, meaning traders need more cash to maintain the same positions. For those opening new long positions, every new contract requires additional cash, significantly raising the entry barrier.

Historical experience shows that CME Group's regulation of silver is often a precursor to price corrections. During the topping process of the silver bull markets in 1980 and 2011, the exchange cooled the market by consecutively raising margin requirements. When the cost of maintaining positions becomes excessively high, speculative capital is forced to liquidate, triggering sharp price corrections.

What are the notable investment targets in the Hong Kong and US stock markets?

For investors, there are various channels to participate in silver trading. In the current extreme market conditions, clarifying the trading instruments is particularly important. Besides futures,$Silver Futures (MAR6) (SImain.US)$ 、 $Micro Silver Futures (MAR6) (SILmain.US)$ 、 $E-mini Silver Futures (MAR6) (QImain.US)$Futubull AI has compiled a list of noteworthy silver stocks and ETFs in the Hong Kong and US stock markets.

In the US stock market, some mining stocks can be considered, including$First Majestic Silver (AG.US)$ 、 $Endeavour Silver (EXK.US)$ 、 $Silvercorp Metals (SVM.US)$ 、 $Pan American Silver (PAAS.US)$ 、 $Fortuna Silver Mines (FSM.US)$ 、 $Wheaton Precious Metals (WPM.US)$ 、 $New Pacific Metals (NEWP.US)$ 、 $Dolly Varden Silver (DVS.US)$ 。

It is worth noting that these mining stocks do not produce silver exclusively but as a byproduct. This is related to the metal refining process, with approximately 71.2% of global silver originating from byproduct or co-product ores of copper, lead-zinc, gold, and other minerals, meaning it is extracted during the mining of other metals. Most of the following Hong Kong-listed companies involved in the silver business sell silver produced from byproduct ores:

$CHI SILVER GP (00815.HK)$ 、 $ZIJIN MINING (02899.HK)$ 、 $CHIFENG GOLD (06693.HK)$ 、 $LINGBAO GOLD (03330.HK)$ 、 $JIANGXI COPPER (00358.HK)$ 、 $CHINAGOLDINTL (02099.HK)$ 、 $ZHAOJIN MINING (01818.HK)$ 、 $SD GOLD (01787.HK)$ 。

Of course, physically-backed silver ETFs, silver mining company ETFs, leveraged and inverse ETFs in the US stock market are also worth considering as tools for trading silver:

$iShares Silver Trust (SLV.US)$ 、 $Abrdn Silver ETF Trust (SIVR.US)$ 、 $Sprott Physical Silver Trust (PSLV.US)$ 、 $Global X Funds Global X Silver Miners Etf (Post Rev Spl (SIL.US)$ 、 $Etf Managers Trust Purefunds Ise Jr Silver Small Miners Exp (SILJ.US)$ 、 $ProShares Ultra Silver (AGQ.US)$ 、 $Proshares Ultrashort Silver (ZSL.US)$ 。

The Ultimate Showdown Between Leveraged Selling and Physical Buying

The future price trend will depend on the contest between two forces: the pressure from leveraged selling and the resilience of physical buying.

If the deleveraging effect triggered by an increase in margin requirements overwhelms physical buying, silver prices will face a significant pullback. This decline could be very rapid, as the unwinding of long positions essentially constitutes selling, which may lead to a stampede effect.

If the shortage in the physical market is severe enough, industrial users and long-term investors may actively step in to buy during price corrections. In this scenario, deleveraging would only clear excessive speculative sentiment but fail to alter silver's long-term upward trajectory. This will determine whether silver’s next major move will be a deep correction or a new high after consolidation at elevated levels.

The price target of $80 represents a significant threshold both technically and psychologically. The upcoming trading sessions will be crucial for both the bulls and the bears in the market.

![]() Looking to pick stocks or analyze them? Want to know the opportunities and risks in your portfolio? For all investment-related questions,just ask Futubull AI!

Looking to pick stocks or analyze them? Want to know the opportunities and risks in your portfolio? For all investment-related questions,just ask Futubull AI!

Editor/Rocky