Bitcoin briefly rose above $90,000 on Monday, indicating that the largest cryptocurrency in the world may be poised for a breakout after missing the Christmas rally that drove stock markets to record highs.

According to Zhitong Finance APP, Bitcoin briefly rose above $90,000 on Monday, indicating that the world's largest cryptocurrency may be poised for a breakout after missing the "Santa Claus rally" that drove stock markets to record highs. Data shows that Bitcoin once surged by 3.1% to $90,200. However, as of the time of writing, Bitcoin reversed course and fell by 0.22%, trading at $87,800.

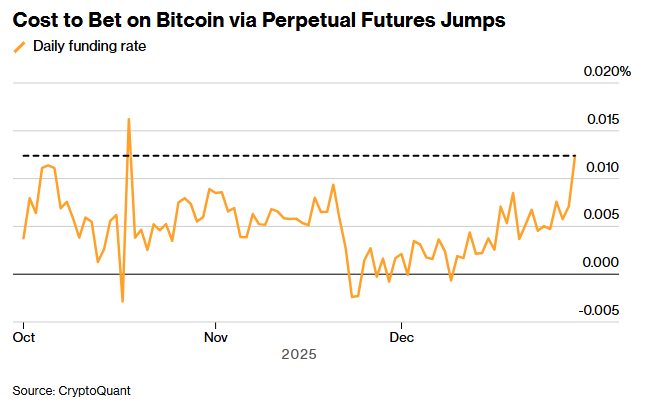

As the S&P 500 index surged and closed at a new high just before Christmas, Bitcoin was largely unaffected. The broader crypto market has yet to recover from a multi-week sell-off that began in October, when about $19 billion worth of leveraged positions were liquidated. This deleveraging 'hollowed out' the market, and traders have since been reluctant to make aggressive bets on a rebound. Despite increasing institutional adoption and a series of policy-level victories achieved under the pro-crypto US President Trump, Bitcoin is still down approximately 4% year-to-date in 2025.

Now, early signs of a shift in market sentiment are beginning to emerge. Sebastian Bea, Chief Investment Officer of ReserveOne Inc., a crypto asset vault company, stated that Bitcoin's rise on Monday 'appears to have been partly driven by short-term retail traders steadily adding positions in the futures market.'

Now, early signs of a shift in market sentiment are beginning to emerge. Sebastian Bea, Chief Investment Officer of ReserveOne Inc., a crypto asset vault company, stated that Bitcoin's rise on Monday 'appears to have been partly driven by short-term retail traders steadily adding positions in the futures market.'

According to CryptoQuant, the Bitcoin funding rate—a key indicator measuring sentiment in the crypto market—has risen to its highest level since October 18, reflecting growing demand for long positions in the perpetual futures market. The open interest in Bitcoin futures contracts has also rebounded from recent lows. However, Sebastian Bea added that this level remains 'far below the peak corresponding to Bitcoin's recent highs in October.'

Grayscale, a giant in crypto asset management, stated in its '2026 Digital Asset Outlook' that 2026 will be the year of accelerated growth for the crypto 'institutional era,' driven by two core factors: rising macro demand for value storage and significant regulatory improvements. The report predicts that Bitcoin is likely to reach new highs in 2026, and the United States may advance bipartisan-supported market structure legislation in 2026 to promote deeper integration of stablecoins, real-world assets (RWA), on-chain securities, and traditional finance. Additionally, asset tokenization may reach an inflection point, with potential growth of up to 1,000 times by 2030. Grayscale highlighted that stablecoins, decentralized finance (DeFi), on-chain revenue, and sustainable cash flow will become key metrics for institutional focus, and industry structural differentiation will further intensify.

However, Matt Hougan, Chief Investment Officer of Bitwise, a US-based crypto asset management firm, recently stated in an interview that Bitcoin is expected to deliver robust but no longer 'explosive' returns over the next decade, with volatility lower than in previous cycles. He believes that steady and continuous institutional buying is supporting prices, making the current pullback significantly smaller than typical declines seen in historical cycles. While he remains optimistic about Bitcoin's performance in 2026, he noted that regulatory tailwinds have largely been priced in, leaving limited room for additional significant upside.

Jurrien Timmer, Head of Global Macro Research at Fidelity, previously wrote that Bitcoin may have already completed the upward phase of its four-year halving cycle, with the $125,000 peak reached in October largely consistent with characteristics of a cycle top. He noted that historically, 'Bitcoin winters' tend to last about a year, and 2026 could become a 'consolidation year,' with key support levels ranging from $65,000 to $75,000. Nevertheless, he emphasized that he remains a long-term Bitcoin bull.

Editor/jayden