Top News

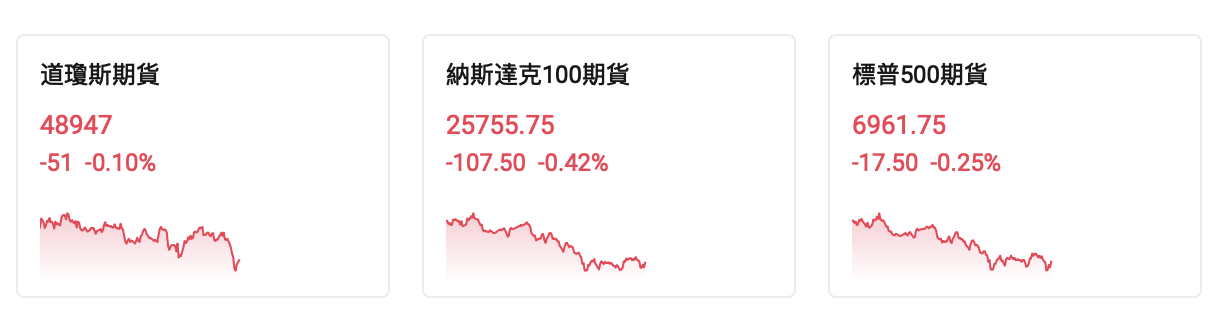

Before the market opened on Monday, the three major futures indices fell in unison. Dow Jones futures dropped by 0.11%, Nasdaq futures declined by 0.42%, and S&P 500 futures fell by 0.25%.

$Star Tech Stocks (LIST2518.US)$ Prices fell across the board before the market opened. $Oracle (ORCL.US)$ 、 $Tesla (TSLA.US)$ 、 $NVIDIA (NVDA.US)$ 、 $Micron Technology (MU.US)$ Down more than 1%.

$Popular Chinese Concept Stocks (LIST2517.US)$ Most stocks fell before the market opened. $Pony AI (PONY.US)$ Dropped more than 3%. $Alibaba(BABA.US)$Fell nearly 3%,$XPeng Motors (XPEV.US)$ 、 $Li Auto(LI.US)$ 、 $Baidu(BIDU.US)$ Dropped more than 2%.

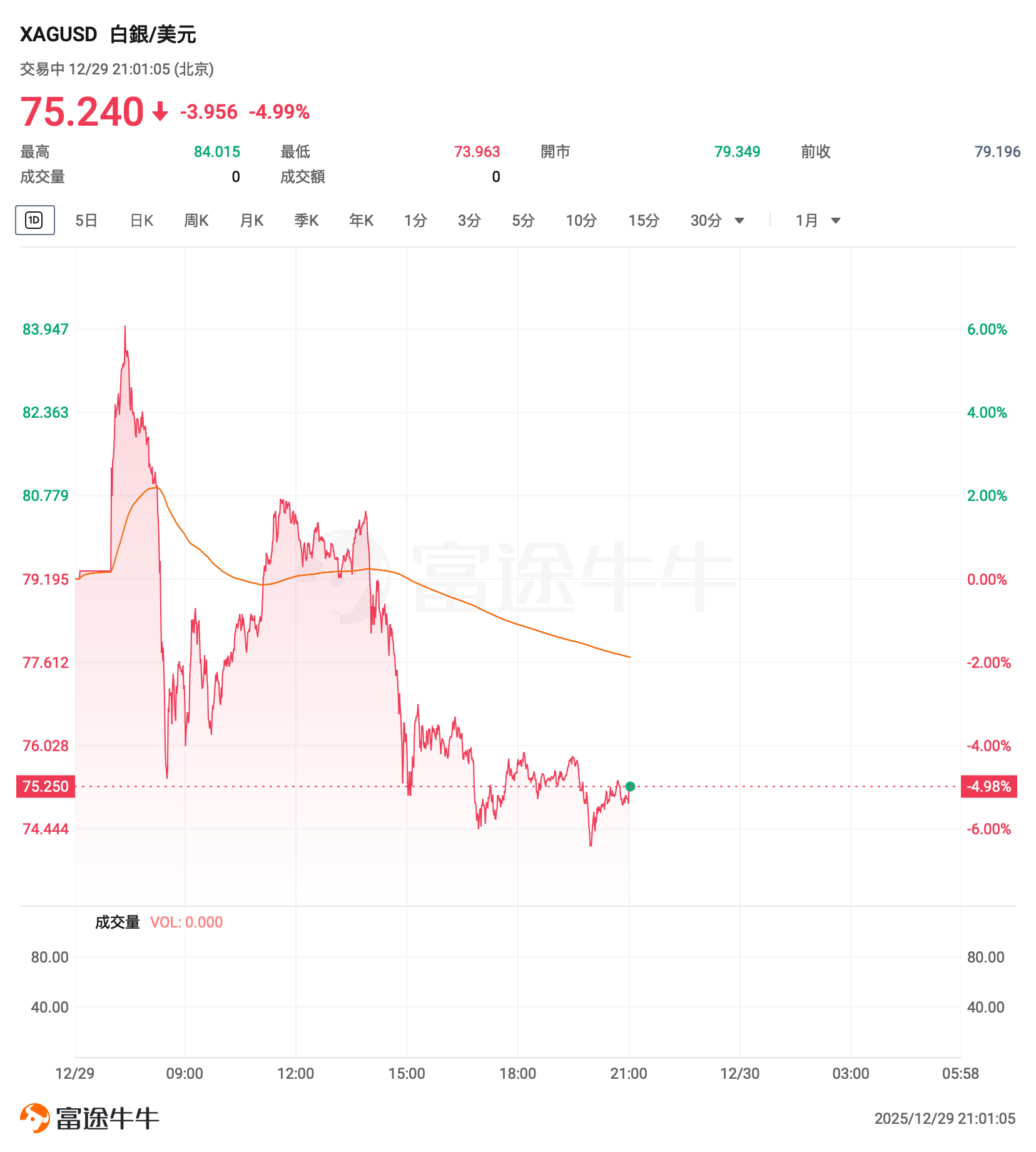

Metals declined across the board in pre-market trading in the U.S. stock market, with gold falling below USD 4,500 and silver dropping nearly 5%. In the domestic market, lithium carbonate and platinum main contracts hit their price limit down.

Metals declined across the board in pre-market trading in the U.S. stock market, with gold falling below USD 4,500 and silver dropping nearly 5%. In the domestic market, lithium carbonate and platinum main contracts hit their price limit down.

Silver/USD (XAGUSD.FX) After a brief surge of 6% to near USD 84/ounce during the morning session, prices plummeted sharply, turning negative on the day by nearly 5% to USD 75/ounce. $黄金/美元(XAUUSD.CFD)$ Falling below the USD 4,500 mark. The main palladium contract at the Guangzhou Futures Exchange hit its price limit down on Monday with a 10% drop, trading at CNY 494.1/gram. The platinum main contract also hit its price limit down, falling 10% to CNY 634.35/gram.

Amid a roller-coaster trading session in spot silver during Monday's early hours, rumors circulated on overseas social media platforms claiming that a systemically important bank had its short positions in silver futures liquidated after failing to meet a $2.3 billion margin call, prompting an emergency injection of $34 billion by the Federal Reserve to stabilize the market. Speculation suggested the involved party could be a major European bank. Analysis indicates that even if the rumors are true, with the European bank’s liquidity reserves standing at $330 billion, the pressure from $7.75 billion in expenditures remains manageable and unlikely to trigger bankruptcy. However, vigilance is warranted against the potential for panic-driven market behavior following the 'sell first, ask questions later' logic.

$Gold(LIST2110.US)$ 、 $Silver (LIST2093.US)$ 、 $Copper (LIST2510.US)$ Declined before the market opened. $Coeur Mining, Inc. (CDE.US)$ 、 $First Majestic Silver(AG.US)$ dropping over 4%, $Endeavour Silver (EXK.US)$ 、 $Pan American Silver (PAAS.US)$ Dropped more than 3%.

BTC briefly surpassed USD 90,000 during the day but retreated, now falling below USD 88,000. $Cryptocurrency-related stocks(LIST20010.US)$ General decline before the market opens, $IREN Ltd(IREN.US)$ 、 $Cipher Mining(CIFR.US)$ Dropped more than 3%.

Inference demand doubles every six months! Citi is optimistic about NVIDIA leveraging Groq LPU to accelerate its product roadmap, maintaining a 'Buy' rating.

Citi issued a research report expressing $NVIDIA (NVDA.US)$ a positive assessment of the $200 billion non-exclusive licensing partnership with AI chip startup Groq, maintaining a 'Buy' rating for NVIDIA with a price target of $270.

It is reported that the scale of this partnership is equivalent to three times Groq’s latest valuation. After the transaction, Groq's founder and president will join NVIDIA. In their report, Citi analysts Atif Malik and Papa Sylla highlighted the dual strategic significance of this partnership: On one hand, following the release of the Rubin CPX GPU in September, NVIDIA indirectly acknowledged the importance of dedicated inference architectures for real-time, cost-effective AI deployments through this partnership, which will help it address competition from TPUs and emerging startups. On the other hand, compared to a full acquisition, the licensing partnership model allows Groq to maintain independent operations, helping to avoid regulatory scrutiny.

The report emphasized that the current demand for hyperscale AI inference is experiencing rapid growth, doubling every six months. NVIDIA’s previously released Rubin CPX GPU uses cost-effective GDDR7 memory, which can reduce total cost of ownership (TCO) by three times compared to expensive HBM memory, and is specifically designed for inference-intensive workloads; Groq's Language Processing Unit (LPU), on the other hand, focuses on real-time inference response, offering advantages in ultra-low latency and efficient processing of language model tokens. By licensing Groq's intellectual property, NVIDIA can quickly incorporate additional inference-optimized computing stacks into its product roadmap without having to build the technology from scratch.

SoftBank Group makes a bold bet on AI infrastructure, reportedly nearing acquisition of data center investment giant DigitalBridge; DigitalBridge shares surged over 28% in pre-market trading.

According to informed sources, SoftBank Group is in advanced negotiations to acquire private equity firm $DigitalBridge Group(DBRG.US)$ in which the latter primarily invests in assets such as data centers. According to the sources, the Japanese conglomerate may announce an agreement for DigitalBridge as early as Monday. This transaction is part of SoftBank's strategic layout to capitalize on the AI-driven digital infrastructure boom. Specific terms have not been disclosed.

The sources noted that a final agreement has not yet been reached, and details, including timing, may still change. Representatives from both SoftBank and DigitalBridge declined to comment.

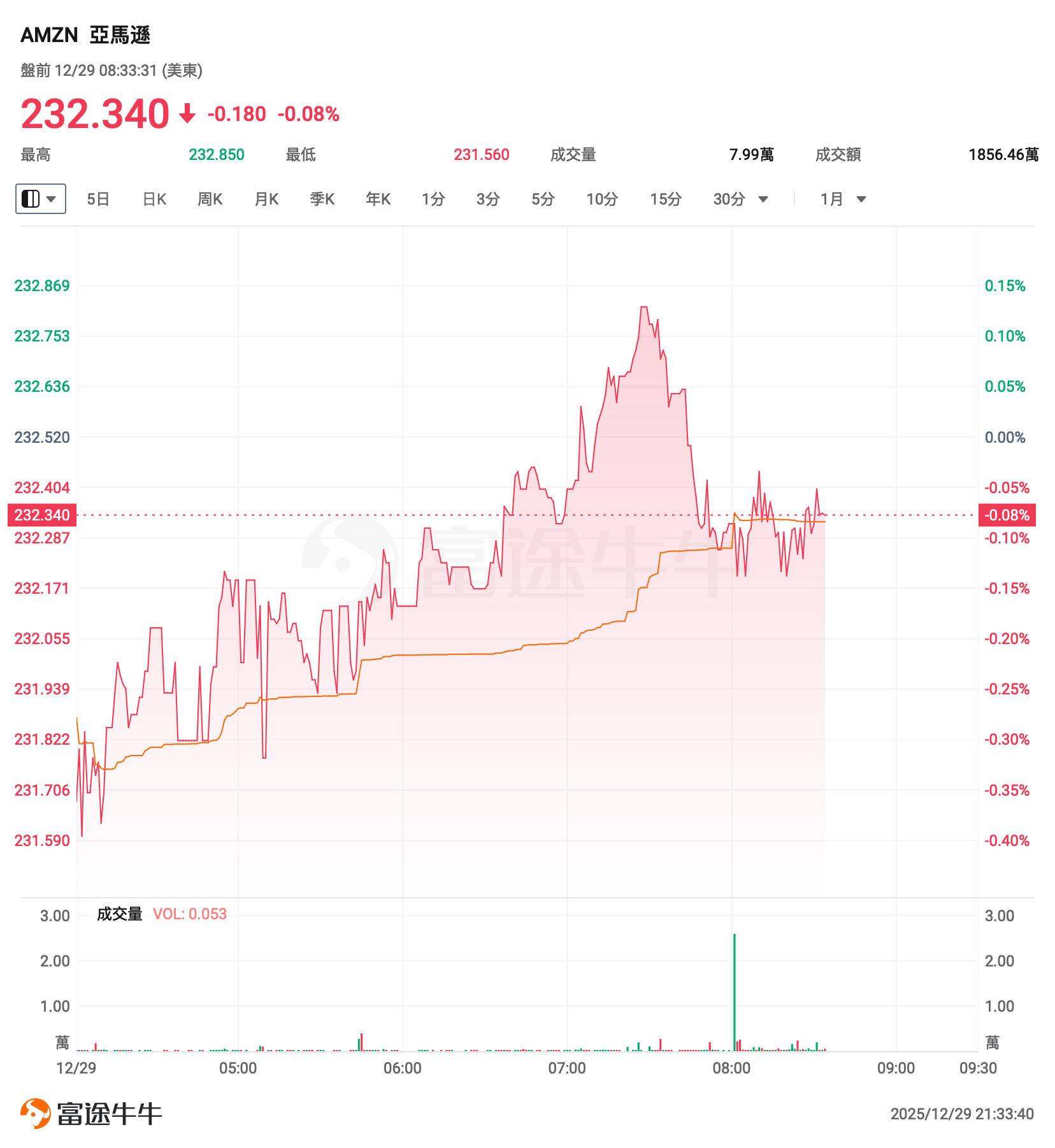

Amazon suspends drone delivery plan in Italy as the commercial regulatory environment becomes a 'major obstacle'.

$Amazon(AMZN.US)$ The company stated that after a strategic review, it has suspended its plans to launch commercial drone delivery services in Italy. An Amazon spokesperson said in an emailed statement, "Although communications with Italy's aviation regulatory authority have been positive and progress has been made, the broader commercial regulatory framework in the country currently does not support the long-term goals of this initiative." This move follows positive discussions Amazon held in June with the Italian Civil Aviation Authority (ENAC).

Intel reaches preliminary cooperation intent with Meilixin Technology, selling 214.8 million shares to NVIDIA.

Global semiconductor leader $Intel (INTC.US)$ an expert delegation recently visited Meilixin Technology. The two parties conducted in-depth discussions on advanced cooling technologies for high-power AI servers and computing infrastructure, reaching a preliminary cooperation intent regarding technical approaches, application scenarios, and collaboration models. Intel highly recognizes Meilixin's systematic capabilities and industrialization advantages in high-performance cooling materials, structural design, and ultra-precision manufacturing. The two sides plan to integrate Intel’s platform-level technological layout with Meilixin’s scaled manufacturing capabilities, relying on a newly established joint venture platform with Juliang Innovation Green Energy, to accelerate the engineering validation and commercial implementation of advanced cooling solutions.

A filing with the U.S. Securities and Exchange Commission (SEC) shows $Intel (INTC.US)$ sold $NVIDIA (NVDA.US)$ 214.8 million shares in a transaction valued at $5 billion.

Guggenheim Partners has assigned a 'Buy' rating to Abivax due to optimism surrounding the prospects of its core drug, obefazimod. Shares of the company rose over 5% in pre-market trading.

Before the French biotechnology company $Abivax S.A.(ABVX.US)$ Prior to the release of data on its core drug obefazimod, Guggenheim Partners raised the company's target price from $150 to $175 and assigned a 'Buy' rating. Analyst Yatin Suneja stated that this adjustment was based on an optimistic outlook for the Week 44 maintenance data (to be released soon) of obefazimod.

A surge in defense investments is sweeping the globe! Citi hails the trend of 're-armament' as inevitable, betting on Raytheon to fully capitalize on international defense industry dividends.

Citi, the Wall Street financial giant, recently released a research report stating that the trend of 'International Rearmament' is set to become a structural and multi-year global demand driver in the military-industrial and defense sector. The report predicts that the military sector in international stock markets will remain one of the hottest investment themes in global equity markets over the next 2-3 years, with the potential to be a core contributor to stock market growth. U.S.-based military-industrial giants $RTX Corp (RTX.US)$ are expected to emerge as one of the key beneficiaries emphasized by Citi due to their significantly higher exposure to international business revenue/orders compared to peers like Lockheed Martin.

South Korean retail giant Coupang rose nearly 3% in pre-market trading after the company offered compensation exceeding $11 billion due to a data breach incident.

South Korean e-commerce retail giant $Coupang(CPNG.US)$ announced that it would provide compensation totaling 1.69 trillion won (approximately $11.7 billion) to 34 million users affected by last month's large-scale data breach.

In a statement released on Monday local time, the company said it plans to offer each eligible customer vouchers worth 50,000 Korean won for various services. Even former users who deactivated their accounts after the data breach are eligible to claim the compensation.

Comcast's valuation is at a low level, with analysts stating that concerns over broadband have been overstated.

Based on 2026 earnings expectations, $Comcast (CMCSA.US)$ is one of the ten lowest-valued stocks in the S&P 500 Index. The company offers a secure dividend yield of nearly 5%, with the current share price trading at six times the 2026 expected earnings, and has repurchased approximately 5% of its outstanding shares in the past 12 months.

However, the company’s stock price has fallen by nearly 18% cumulatively, currently trading at around $29.6, even lower than levels seen a decade ago. As the largest cable TV and broadband operator in the U.S., Comcast's related business scale is slowly shrinking. Analysts believe that the market may be overly pessimistic about the future of its broadband business.

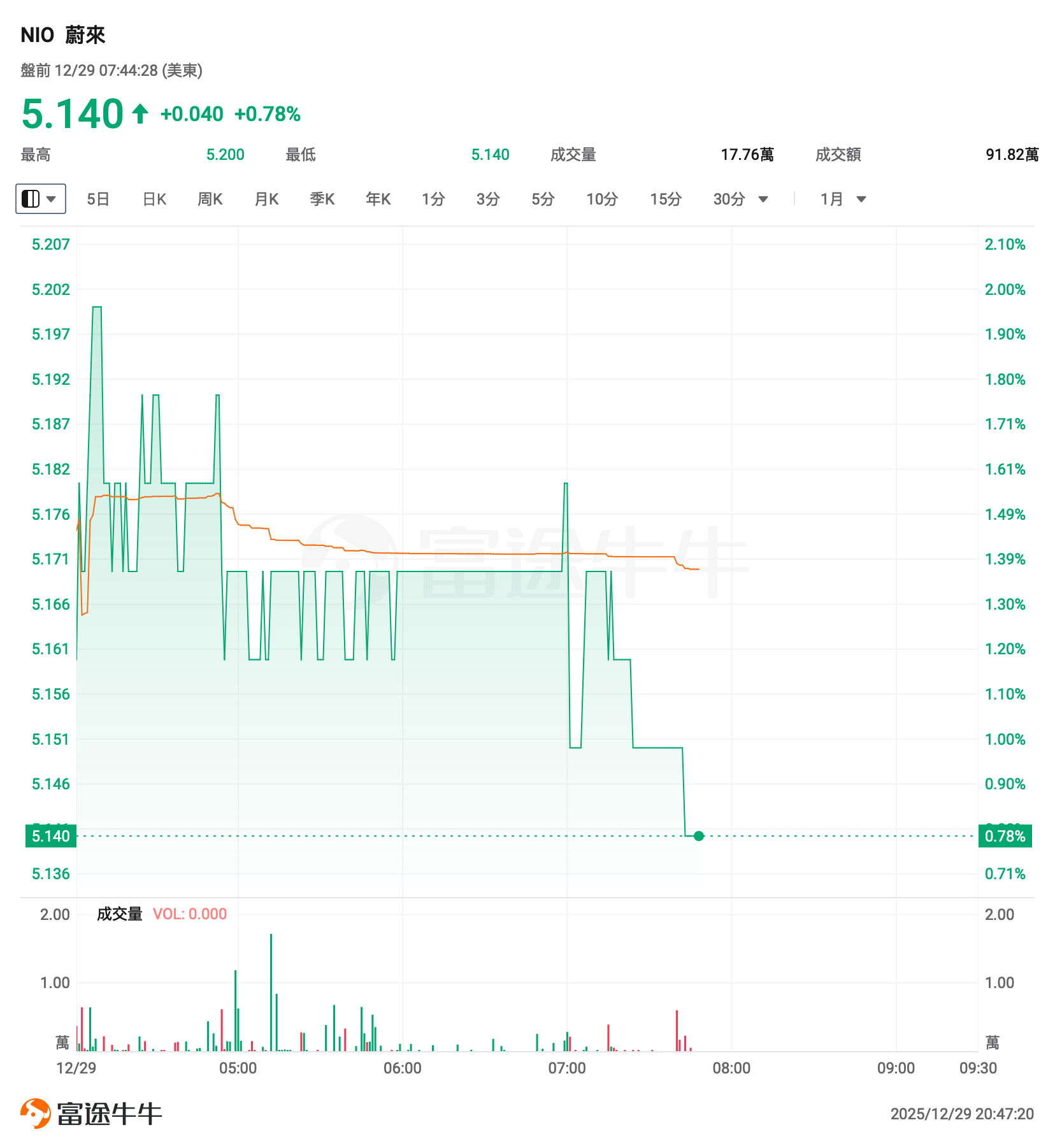

Driven by multiple positive factors, Nio's shares rose nearly 1% against the trend in pre-market trading, while its H-shares closed up nearly 5% today.

$Nio-SW(09866.HK)$ The H-shares closed nearly 5% higher today, driving $Nio (NIO.US)$ U.S. stocks rose nearly 1% in pre-market trading. In terms of news, Nio achieved a milestone of delivering the 30,000th unit of its third-generation ES8 and completed delivery of the 40,000th vehicle just 11 days later; Nio’s Yunnan-Tibet battery swap route is about to be fully operational with the Deqin Meili Snow Mountain station going live on January 1, spanning over 2,700 kilometers with 19 battery swap stations deployed; additionally, Nio has partnered with Shanghai Electric to give retired batteries a 'new life' in energy storage stations.

Taiwan Semiconductor's 2-nanometer technology has officially entered mass production in the fourth quarter of 2025 as scheduled, while reports indicate that pricing for advanced processes below 3 nanometers will increase next month.

According to $Taiwan Semiconductor (TSM.US)$ According to the 'Logic Process' page on Taiwan Semiconductor’s official website, its 2-nanometer (N2) technology has begun mass production in the fourth quarter of 2025 as planned. As of November 21, the description still read 'development is proceeding as planned with good progress,' but the logic process roadmap was most recently updated on December 16 this year, confirming that mass production commenced not long ago. Taiwan Semiconductor stated that N2 technology adopts the first generation of Nanosheet (GAA) transistor technology, offering full-node improvements in performance and power consumption, making it the most advanced semiconductor technology in the industry in terms of density and energy efficiency.

According to Taiwan’s Economic Daily News, driven by the booming AI applications, capacity for Taiwan Semiconductor's advanced processes below 3 nanometers remains tight. Reports suggest that Taiwan Semiconductor has communicated with its clients and will raise prices for advanced processes consecutively over four years from 2026 to 2029, with new pricing taking effect on January 1, 2026. Industry insiders believe that next year, $NVIDIA (NVDA.US)$ 、 $Advanced Micro Devices (AMD.US)$ major clients such as [specific names omitted] are set to launch new platforms, combined with $Broadcom (AVGO.US)$ non-Apple clients aggressively expanding their AI application fields, which will serve as key drivers for Taiwan Semiconductor’s sustained high demand for advanced processes below 3 nanometers.

Space concept stocks$Sidus Space(SIDU.US)$ Trading activity remained robust, with shares rising more than 15% in pre-market trading after falling 12% in the previous session.

U.S. macroeconomics

Concerns over the Federal Reserve's independence persist as the Bank of America CEO warns the market may 'punish everyone.'

Brian Moynihan, Chairman and Chief Executive Officer of Bank of America, warned that if the Federal Reserve loses its independence, the market will punish everyone; since Trump assumed the U.S. presidency, he has consistently criticized the Fed for lagging in easing monetary policy, raising concerns about potential U.S. government interference in the Federal Reserve; Moynihan emphasized that the Fed should remain low-profile and also suggested that low interest rates may not necessarily benefit the U.S. economy.

"I may be early, but I'm not wrong!" The Big Short's Burry once again goes against the market trend by shorting AI giants NVIDIA and Palantir.

Michael Burry, the prototype of 'The Big Short,' has once again bet against NVIDIA and Palantir, asserting that the AI boom is a repeat of the internet bubble. He criticized NVIDIA for using accounting logic to obscure the risk of future asset write-downs by clients, pointing out that its official response is misleading. Despite frequent criticism that his predictions are premature, Burry remains steadfast in his bearish stance, stating, 'I may be early, but I am not wrong!'

The Bank of Japan’s rate hike journey is far from over! Officials noted that real interest rates are among the lowest globally and called for rate hikes every few months.

On Monday morning this week, the minutes from the Bank of Japan’s December meeting revealed that some members of the central bank’s monetary policy committee currently believe Japan’s real interest rates remain extremely low. Not only did they push for a rate hike at the December meeting, but they also supported further increases next year. Influenced by this, the yen strengthened early Monday morning.

According to the minutes of the meeting, at the two-day conference concluded on December 19, one of the nine committee members stated, "Japan's real policy interest rate is currently at the lowest level globally." "It is appropriate for the central bank to adjust the degree of monetary easing." This unnamed member also frankly stated that he believed the Bank of Japan’s policy rate was far from reaching a neutral level, saying, "It can be argued that there is still a considerable distance from the neutral interest rate level."

Trump previews the theme for the 2026 midterm elections: 'Pricing' issues to take center stage

Trump, in an exclusive interview with POLITICO, stated that the 2026 midterm elections would revolve around the issue of 'pricing.' He claimed that his administration was cleaning up the 'mess' inherited from the Biden administration, citing price reductions as evidence of their achievements.

However, an imminent economic headwind facing Trump is the possibility of another government shutdown by the end of January next year. He once again urged Senate Republicans to abolish the 'filibuster' rule, which he believes has become an obstacle to governance.

JPMorgan: Multiple factors will impact the U.S. job market, with slow growth potentially occurring in the first half of 2026.

JPMorgan forecasts that the U.S. labor market will experience "disturbingly slow growth" in the first half of 2026, with the unemployment rate peaking at 4.5% at the beginning of the year; the report states that uncertainties brought by Trump's trade policies, along with his immigration control measures, have reduced the labor supply; despite multiple challenges, JPMorgan predicts that the U.S. labor market will reverse the situation in the second half of 2026.

"The Godfather of AI" raises alarm: AI capabilities double every seven months, and 2026 will bring another wave of unemployment!

Renowned computer scientist Geoffrey Hinton, often referred to as the "Godfather of Artificial Intelligence," warned that artificial intelligence (AI) will replace many jobs in 2026, leading to a new wave of "unemployment." Hinton noted that advancements in AI increasingly threaten some white-collar jobs, with the volume of tasks it can perform nearly doubling approximately every seven months.

Trillions in funding loaded! Silicon Valley startups raise record-breaking capital this year, with companies like OpenAI displaying unmatched financial firepower.

According to industry statistics, the hottest startups in Silicon Valley have raised $150 billion (approximately 1.05 trillion RMB) in funding this year, as their financial backers advised them to build "fortress-like" balance sheets to protect against a potential cooling of the artificial intelligence investment boom next year. Data from PitchBook shows that in 2025, financing by the largest unlisted companies in the United States hit a record high—far surpassing the previous record of $92 billion in 2021—as venture capital firms rushed to support top artificial intelligence enterprises such as OpenAI and Anthropic.

This year's surge in financing is primarily due to several unprecedented large deals. These include SoftBank Group's leadership in OpenAI's $41 billion financing round, Anthropic's $13 billion financing completed in September, and $Meta Platforms(META.US)$ an investment of over $14 billion into Scale AI, a data labeling startup.

Inside Story of the Largest U.S. Power Grid 'Capacity Auction': Without Price Controls, the AI Boom Would Have Driven Electricity Prices Up by 60%

The growing demand for AI and data centers is pushing the U.S. power grid to its limits. The latest capacity auction by PJM, the largest grid operator in the United States, shows that capacity prices for 2027/28 have hit the upper limit of $333.4, while simulated "shadow prices" suggest that the true costs could be 60% higher. Goldman Sachs has warned that if future auctions remove the price cap, electricity bills could double, forcing the United States to face an extreme test of choosing between advancing AI development and maintaining basic power reliability.

Are "the most dangerous creditors" stepping in to buy U.S. debt? Foreign governments are taking a back seat as "profit-hungry" vultures circle in.

As of December 2025, the size of the U.S. federal government debt has exceeded $38.5 trillion, continuing to set new historical records. Behind this figure, a profound shift in the buyer base is also underway; over the past decade, the structure of U.S. Treasury holders has undergone a dramatic change, with more private investors pursuing profits, while the share of foreign government investors, who are less sensitive to price fluctuations, has continued to decline.

Although foreign governments have not sold off their Treasury holdings and their total holdings remain roughly the same as 15 years ago, they have not increased purchases in line with the surge in U.S. Treasury issuance. Meanwhile, private investors represented by hedge funds have absorbed a significant portion of the Treasury supply, but they are more likely to demand higher yields, thereby exacerbating interest rate volatility.

Geopolitical tensions continue to disrupt global energy markets, causing international oil prices to fluctuate upward.

International oil prices edged higher during the Asian trading session on Monday, with WTI crude rising 0.99% to $57.3 per barrel and Brent crude climbing 1.01% to $60.85 per barrel. Geopolitical events in the Middle East rattled the market, with significant obstacles remaining in Russia-Ukraine peace talks, Saudi Arabia launching airstrikes in Yemen, and Iran declaring a state of 'full war,' fueling concerns over potential supply disruptions.

What’s the Signal? Three Prominent ‘Big Shorts’ Unanimously Predict: By 2026, the US Dollar Will Fall and Gold Will Rise!

Three prominent 'Big Short' traders—Danny Moses, Vincent Daniel, and Porter Collins—have made similar macroeconomic forecasts for 2026, all predicting pressure on the U.S. dollar and upside potential for gold. They agree that currency depreciation trades will support precious metal prices, with Daniel expressing optimism about the growth potential of emerging markets such as China and Brazil.

Top 20 pre-market trading volume stocks in the U.S. stock market

U.S. Stock Market Macroeconomic Calendar Reminder

(The following times are in Beijing Time)

11:00 PM U.S. November pending home sales index month-over-month rate

23:30 EIA Weekly Crude Oil Stocks (in million barrels) for the week ending December 19 in the U.S., EIA Weekly Cushing, Oklahoma Crude Oil Stocks (in million barrels) for the week ending December 19 in the U.S., EIA Strategic Petroleum Reserve Stocks (in million barrels) for the week ending December 19 in the U.S., Dallas Fed Business Activity Index for December in the U.S.

Next day

01:00 U.S. EIA Natural Gas Inventory for the week ending December 19 (in billion cubic feet)

Looking to pick stocks or analyze them? Want to know the opportunities and risks in your portfolio? For all investment-related questions,just ask Futubull AI!

Editor/Doris