Hedge fund veteran Campbell warned of short-term risks for silver, including tax-driven year-end selling, pressure from a stronger US dollar, reduced leverage due to margin hikes,Technicallyoverbought conditions, and the threat of substitution by copper. Additionally, the January rebalancing of the Bloomberg Commodity Index will force passive funds to sell positions equivalent to 9% of the open interest in the silver futures market.

Following a 25% surge in silver prices in a single month, Alexander Campbell, a hedge fund veteran who accurately predicted the rise in silver prices earlier this year in February, has issued a latest warning. Although the long-term bullish logic remains unchanged, investors should be wary of a potential pullback triggered by five key short-term risk factors.

On Monday (December 29), spot silver experienced significant volatility, surging by 6% in early trading before plummeting. It is currently down over 7% to $73.478 per ounce, following a record single-day gain in dollar terms just last Friday.

Alexander Campbell, a hedge fund veteran, former global macro investor at Bridgewater Associates, and current founder and CEO of Black Snow Capital, noted in his latest Substack article that as the new year approaches, markets face multiple pressures including tax-driven selling, a rebound in the US dollar, margin increases, overbought technical conditions, and threats from copper substitution.

Alexander Campbell, a hedge fund veteran, former global macro investor at Bridgewater Associates, and current founder and CEO of Black Snow Capital, noted in his latest Substack article that as the new year approaches, markets face multiple pressures including tax-driven selling, a rebound in the US dollar, margin increases, overbought technical conditions, and threats from copper substitution.

Notably, apart from Campbell's warnings, a 'technical storm' driven by passive funds is also looming. According to Zuitrade Terminal reports, the Bloomberg Commodity Index (BCOM) will undergo its annual weight rebalancing in January 2026. Given that silver significantly outperformed other commodities over the past three years, passive funds will be forced to sell positions equivalent to approximately 9% of the total open interest in the futures market—a scale far exceeding previous years, potentially exacerbating market volatility in January.

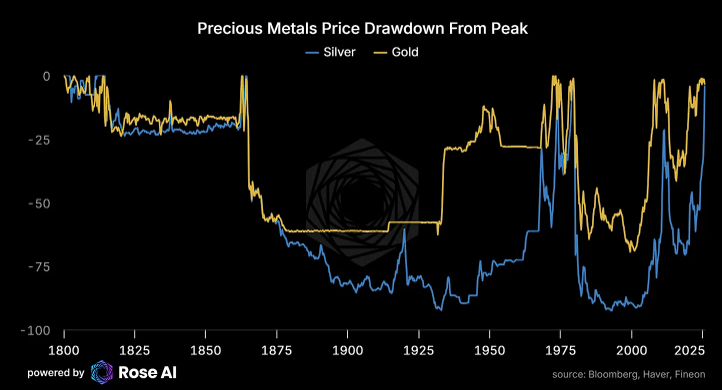

Despite short-term risks, Campbell's long-term bullish stance on silver remains unchanged. He pointed out that the large price gap between the spot and futures markets, coupled with London's deepest spot premium structure in decades, reflects structural supply-demand imbalances.

Five key short-term risks are becoming increasingly evident.

Campbell provided a detailed analysis of the short-term pressures facing silver.

The primary risk stems from tax-driven selling.

For investors holding substantial unrealized gains, selling before December 31 would incur short-term capital gains tax, prompting traders to hold their positions until year-end to benefit from preferential long-term capital gains tax rates. This implies selling pressure may ease during the final three trading days of 2025 but could lead to concentrated profit-taking after January 2, 2026.

The second risk is the strengthening of the US dollar.

The latest GDP data shows robust economic growth in the third quarter, which could drive a short-term rebound in the US dollar. A stronger dollar typically pressures commodities priced in dollars.

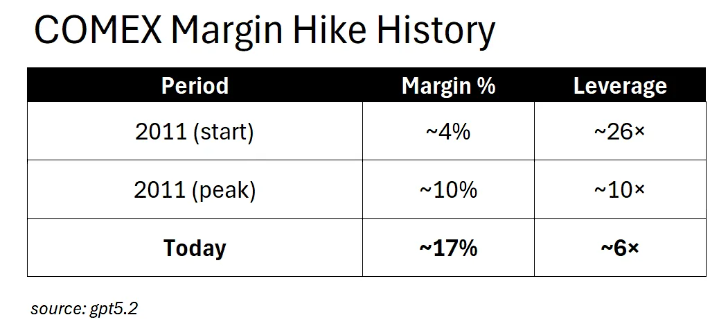

Thirdly, the CME Group announced an increase in silver margin requirements effective December 29.

Campbell acknowledged that this would reduce leverage and speculative demand, but he noted that the current margin level has reached 17% of the nominal value, significantly higher than the peak of 10% during the silver price crash in 2011. The current leverage is only 6 times, compared to as high as 25 times in early 2011. Therefore, the impact of this margin increase is much smaller than the consecutive hikes in 2011.

The fourth risk comes from the technical side.

Many analysts have pointed out that silver has entered the 'overbought' zone, and technical selling may trigger more sell-offs. However, Campbell questioned this assessment, arguing that the rise in silver prices is driven by rigid demand from the solar industry and a lack of supply elasticity, rather than purely technical speculation.

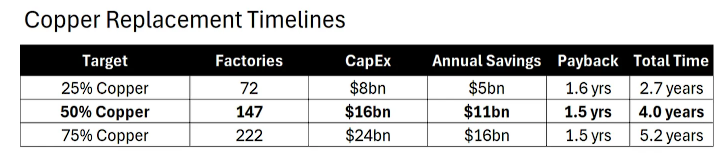

The fifth risk is the threat of copper substitution.

As silver prices soar, solar manufacturers may shift to using copper. Although Campbell noted that substituting copper for silver in industrial applications requires at least a four-year cycle, in the context of skyrocketing prices, these narratives are sufficient to trigger technical selling in the short term.

Index rebalancing may exacerbate volatility.

In addition to the five risks mentioned by Campbell, the market faces another technical pressure.

According to information from the Wind Trading Desk, JPMorgan noted in a research report released on December 12 that the Bloomberg Commodity Index will undergo its annual weight rebalancing in January 2026. As gold and silver have outperformed other commodities for three consecutive years, their weights in the index have naturally risen to excessively high levels.

To bring the weights back in line with the target allocation, passively managed funds tracking the index will be forced to sell their precious metals futures positions. JPMorgan estimates that silver could face selling equivalent to 9% of its total open interest in the futures market, while gold may see sales of approximately 3%. This mandatory selling operation will be concentrated during the index roll period from January 8 to 14, 2026.

The assets tracking the Bloomberg Commodity Index exceed $600 billion, and such a massive adjustment in positioning is bound to amplify market volatility. This coincides closely with the tax-driven selling window warned by Campbell, potentially creating a resonance effect.

Long-term fundamentals remain robust.

Despite short-term risks, Campbell's long-term enthusiasm for silver has not diminished, as he cited deep structural factors supporting silver prices.

The physical market shows structural tightness. Campbell noted that the current spot price of silver in Dubai is $91 per ounce, $85 per ounce in Shanghai, while COMEX futures are only at $77 per ounce. The physical market premium is as high as $10-$14.

Campbell pointed out, "When there is such a large divergence between the spot market and the futures market, one of them is wrong, and historically, it is not the spot market that has been wrong."

The spot premium structure in the London over-the-counter (OTC) market has reached its deepest level in decades. A year ago, this market was still in a normal contango state (spot at $29, forward curve rising to $42), but it has now turned into backwardation (spot at $80, forward curve falling to $73). This inverted structure, where spot prices exceed forward prices, typically indicates physical tightness in the market.

Investment demand resonates with industrial demand.

From the perspective of investment demand, positioning data shows that the silver market is not overly crowded. According to the U.S. Commodity Futures Trading Commission (CFTC), speculative net long positions account for 19% of open interest, compared to 31% for gold. This suggests that silver still has room to rise.

Holdings in silver ETFs, such as the iShares Silver Trust, have started to climb again after years of outflows. Rising prices have instead driven up demand, a characteristic akin to a "Veblen good," indicating that silver is gaining monetary demand properties rather than being viewed solely as an industrial commodity.

The options market is also repricing tail risks. The implied volatility of at-the-money options has risen from 27% a year ago to 43%, while the implied volatility of out-of-the-money call options has reached 50-70%. This indicates that the options market is pricing in significant upside potential for silver.

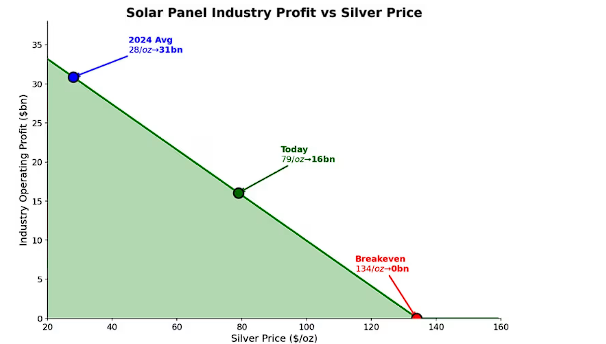

In terms of industrial demand, demand from the solar energy sector provides long-term support. The sector’s silver demand will reach 290 million ounces in 2025 and is expected to rise to 450 million ounces by 2030. Campbell emphasized that after 25 years without demand growth, the rise of the solar energy industry has fundamentally transformed the silver market landscape.

The electricity demand from data centers and artificial intelligence further reinforces this logical chain: 'Every AI query requires electrons; marginal electrons come from solar power, and solar power requires silver.' Campbell stated that the break-even point for the solar energy industry is $134 per ounce, which is approximately 70% higher than the current spot price.

![]() Looking to pick stocks or analyze them? Want to know the opportunities and risks in your portfolio? For all investment-related questions,just ask Futubull AI!

Looking to pick stocks or analyze them? Want to know the opportunities and risks in your portfolio? For all investment-related questions,just ask Futubull AI!

Editor/jayden