①The global precious metals market experienced significant turbulence on Monday, with spot silver falling nearly 11% during the day and spot gold dropping over 4%; ②Amidst this sharp adjustment, the CME Group's comprehensive increase in margin requirements for metal futures contracts drew market attention; ③Due to 'structural supply-demand imbalances' and various external factors, the contest in the precious metals market is expected to continue.

Cailian Press News, December 30 (Editor: Shi Zhengchi) The recent surge in metals led by silver encountered a notable correction on Monday. As selling pressure intensified during the U.S. trading session late at night, both futures and spot prices of gold, silver, platinum, and palladium recorded significant declines.

As of press time, spot silver reversed an intraday gain of nearly 6% to fall over 8%, with a drop nearing 11% during the day, resulting in volatility exceeding 16 percentage points; Comex silver also fell more than 7%. Earlier, the overnight session of the Shanghai silver futures closed with a loss exceeding 8%.

Affected by this downturn, both spot gold and Comex gold dropped nearly $200 during the day, with a single-day decline exceeding 4%. Spot and futures platinum fell nearly 13%, while palladium products dropped over 15%.

Affected by this downturn, both spot gold and Comex gold dropped nearly $200 during the day, with a single-day decline exceeding 4%. Spot and futures platinum fell nearly 13%, while palladium products dropped over 15%.

In terms of news, the CME Group released a margin adjustment notice last Friday, raising margin requirements across the board for recently popular contracts such as silver, gold, platinum, palladium, and lithium carbonate, along with their corresponding Trade at Settlement (TAS) contracts. The new margin requirements took effect after the market close on Monday (December 29).

When futures markets experience overheated speculation, exchanges typically reduce leverage to mitigate the risk of market disorder. However, due to the famous confrontation between the CME and silver speculators, it tends to attract more market attention.

In short, the two historical peaks of silver in 1980 and 2011 were closely related to the CME. From 2010 to 2011, driven by quantitative easing and the European debt crisis, silver surged from $8.5 to $50. After silver hit its all-time high back then, the CME raised margin requirements five times within just two weeks, stripping aggressive capital of leverage and triggering a sharp 25% decline in a single week.

An even more famous event was the Hunt Brothers’ silver speculation bankruptcy in the 1970s and 1980s. At that time, the Texas oil tycoons, the Hunt Brothers, manipulated silver prices through massive accumulation of silver futures, driving silver from $6 to nearly $50 in a short period. In response to speculative sentiment, the New York Mercantile Exchange repeatedly doubled margin requirements and eventually announced that silver futures contracts could only be unwound and not added to.

Unsurprisingly, the Hunt Brothers were quickly liquidated, and the price of silver rapidly returned to single digits.

However, times have changed. Unlike the previous two major surges in silver prices, which were primarily driven by speculation, this round of price increases has been supported by tightening physical supplies, or what might be called 'structural supply-demand imbalances'.

As an excellent electrical conductor, silver is widely used in industrial applications such as circuit boards and switches, electric vehicles, and batteries. Silver paste is also a critical component of solar panels. Additionally, similar to gold, silver is often utilized in the production of coins and jewelry. Due to its significantly lower price per unit compared to gold, it is highly favored by retail consumers.

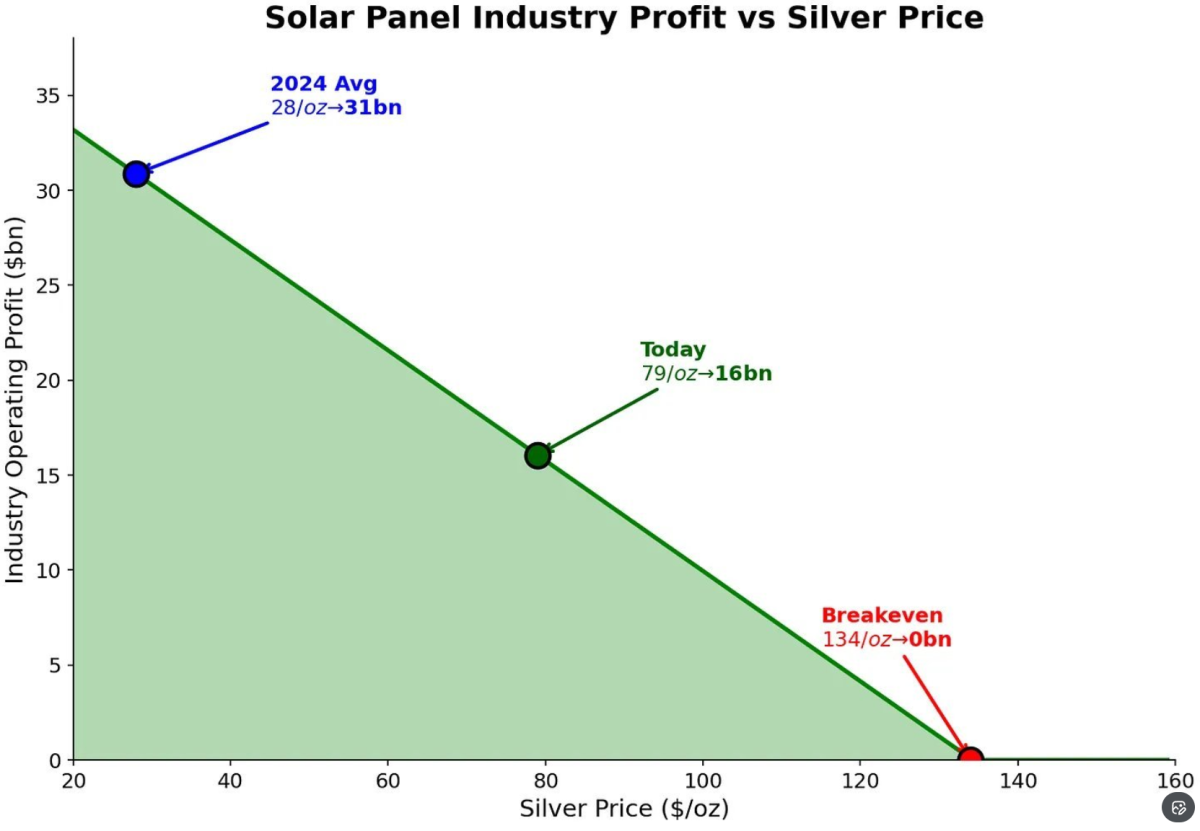

Consequently, silver prices are closely monitored as part of national industrial policies. Renowned silver bull trader Karel Mercx shared on social media that over the past year, profits in the photovoltaic industry have dropped from $31 billion to $16 billion. If silver prices surge to $134 per ounce, the photovoltaic industry could become unprofitable.

Furthermore, due to potential U.S. tariff impacts, traders stockpiling metals in the United States may squeeze supply in overseas markets.

The current situation where silver's rise far exceeds that of gold has another key factor: the silver market is much smaller in scale.

For instance, in the London market, the total value of silver stored in London is approximately $65 billion, while the value of gold reaches nearly $1.3 trillion. For gold, an important stabilizing factor behind the London market is roughly $700 billion worth of physical gold, primarily held by central banks worldwide in the vaults of the Bank of England. During periods of liquidity crunches, this gold can be lent out, effectively allowing central banks to act as "lenders of last resort." However, no such strategic reserve exists for silver.

Editor/Stephen