U.S. major stock indexes closed lower on Monday, with the Dow Jones and Nasdaq down 0.5%, the biotech index falling more than 0.7%, and the Philadelphia Bank Index dropping 1.1%. The airline industry ETF fell nearly 1.3%, leading declines among U.S. sector ETFs. Spot silver plunged over 8% in a single day, briefly breaking below the $71 mark. Gold quickly retreated from its record high to near $4,300.

The 'Santa Claus rally' took a pause on Monday as both the previously surging precious metals and stock markets experienced a pullback.

U.S. equities were under broad pressure that day, with technology stocks collectively weakening. Traders widely interpreted this as typical year-end portfolio adjustments. Meanwhile, U.S. Treasuries saw modest buying interest, and as risk assets gave back gains, funds began to flow back into defensive assets in phases.

Previously setting new all-time highs continuously, $XAG/USD (XAGUSD.FX)$ experienced a 'stampede-like' retreat on Monday, plummeting over 8% in a single day and briefly breaking below the $71 mark. $XAU/USD (XAUUSD.CFD)$ It quickly retreated from its historical high to near $4,300. Domestic metal futures also slumped, with Shanghai silver night session closing down 8.74%. The Shanghai gold night session broke below the 1,000-yuan mark, settling at 975.80 yuan per gram.

Previously setting new all-time highs continuously, $XAG/USD (XAGUSD.FX)$ experienced a 'stampede-like' retreat on Monday, plummeting over 8% in a single day and briefly breaking below the $71 mark. $XAU/USD (XAUUSD.CFD)$ It quickly retreated from its historical high to near $4,300. Domestic metal futures also slumped, with Shanghai silver night session closing down 8.74%. The Shanghai gold night session broke below the 1,000-yuan mark, settling at 975.80 yuan per gram.

Analysts attributed the sharp decline to CME Group's margin requirement increase, insufficient holiday liquidity, profit-taking in some Asian markets, and the highly concentrated speculative positioning, which caused prices to fall rapidly once marginal buying dried up.

Additionally, overseas social media rumors claimed that a systemically important bank was forced to liquidate due to a short squeeze on silver futures, failing to pay a $2.3 billion margin call, prompting an emergency $34 billion capital injection by the Federal Reserve to stabilize the market.

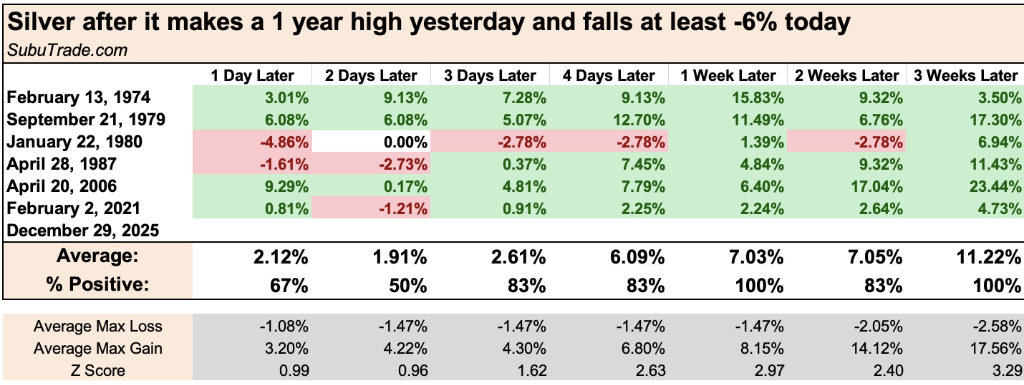

Notably, despite such a dramatic drop, gold and silver prices merely returned to levels seen just days earlier. From a temporal perspective, this appears more like an abrupt brake on overheated momentum rather than a trend reversal. Historical data shows that after silver prices fell over 6% from their one-year high, they rebounded within a week in all six previous instances.

Not only were precious metals hit hard, but the cryptocurrency market also experienced a rapid rise and fall within a 12-hour period. $Bitcoin (BTC.CC)$ A surge followed by a pullback occurred again, briefly surpassing $90,000 before quickly retreating below $87,000, continuing the relatively weak performance seen recently.

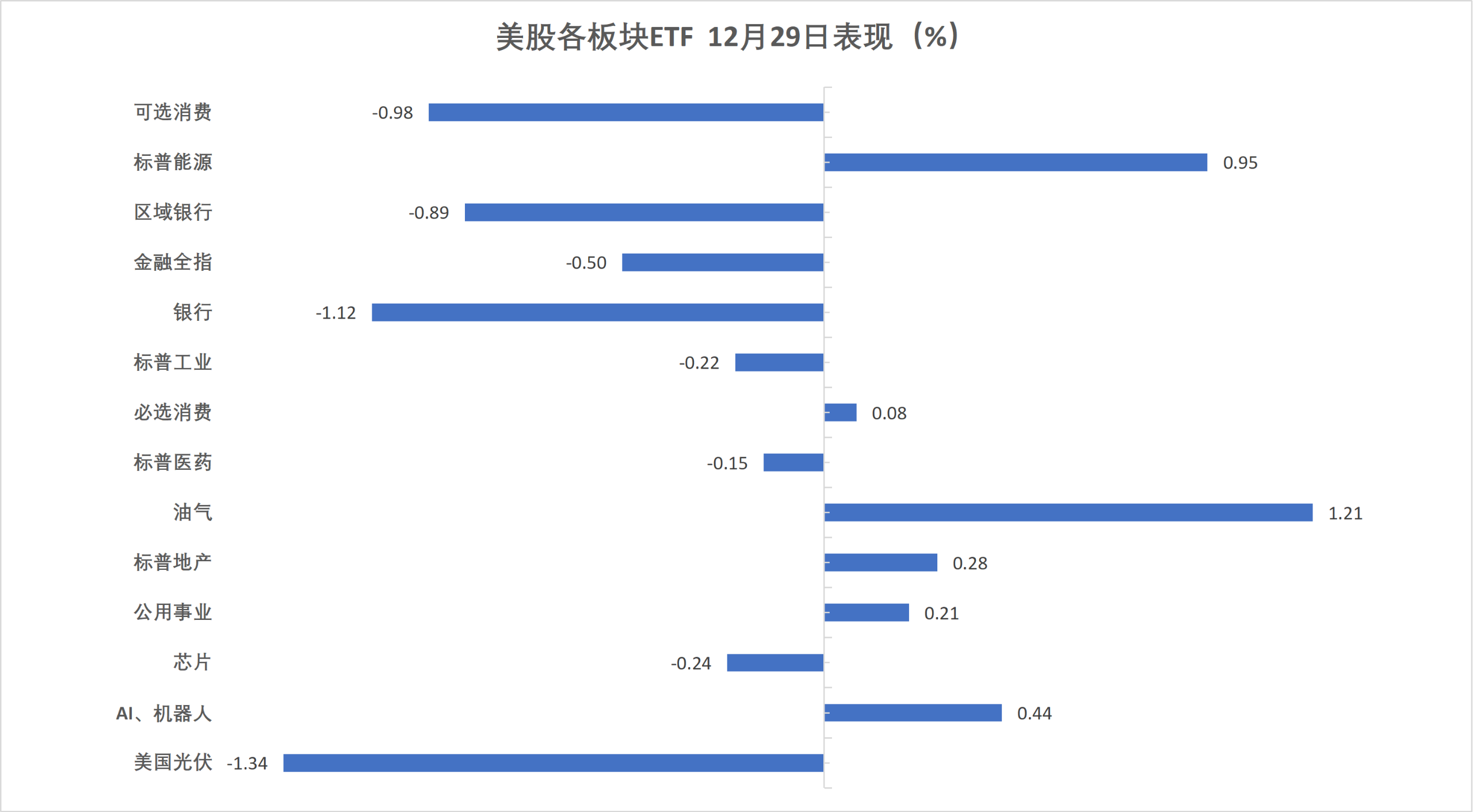

The three major U.S. stock indexes closed lower on Monday.$Dow Jones Industrial Average (.DJI.US)$ 、 $Nasdaq Composite Index (.IXIC.US)$The biotech index fell more than 0.7%, the Philadelphia banking index dropped 1.1%. The airline industry ETF closed down nearly 1.3%, leading the declines among U.S. sector ETFs.

Benchmark US Equity Indices:

The S&P 500 Index closed down 24.20 points, or 0.35%, at 6905.74.

The Dow Jones Industrial Average closed down 249.04 points, or 0.51%, at 48461.93.

The Nasdaq Composite Index closed down 118.748 points, or 0.50%, at 23474.349. The Nasdaq 100 Index closed down 118.83 points, or 0.46%, at 25525.56.

Russell 2000 IndexClosed down 0.57% at 2519.80.

The VIX volatility index, known as the 'fear gauge,' closed up 0.97% at 13.60.

U.S. Sector ETFs:

The global airline industry ETF closed down 1.27%, the consumer discretionary ETF fell 0.89%, regional bank ETFs and banking ETFs dropped at least 0.88%, and the biotech index ETF declined 0.74%.

Mag 7:

The Mag 7 index fell by 0.55% to close at 208.94 points.

$Tesla (TSLA.US)$ Closing down 3.27%, $NVIDIA (NVDA.US)$ Fell by 1.21%, $Meta Platforms (META.US)$ 、 $Amazon (AMZN.US)$ 、 $Microsoft (MSFT.US)$ Down by as much as 0.69%, $Alphabet-A (GOOGL.US)$ 、 $Apple (AAPL.US)$ While some closed up by as much as 0.13%.

Chip Stocks:

$PHLX Semiconductor Index (.SOX.US)$ Closed down 0.41% at 7,178.272 points.

$Taiwan Semiconductor (TSM.US)$ Closed down 0.63%, $Advanced Micro Devices (AMD.US)$ Up 0.29%; $Micron Technology (MU.US)$ Surging over 3.41%, $Intel (INTC.US)$ Increased by 1.33%.

Chinese Concept Stocks:

The Nasdaq Golden Dragon China Index closed down 0.67% at 7,636.97 points.

Among popular Chinese stocks, $Xiaomi Corp. Unsponsored ADR Class B (XIACY.US)$ Closed down 3.7%, $Alibaba (BABA.US)$ Decreased by 2.4%, $Li Auto (LI.US)$ 、 $TENCENT (00700.HK)$ 、 $XPeng (XPEV.US)$ 、 $Yum China (YUMC.US)$ with declines exceeding 1%. $NetEase (NTES.US)$ up 0.8%, and $Baidu (BIDU.US)$ Increased by 1.6%, $NIO Inc (NIO.US)$ Surged by 4.8%.

Other stocks:

$Eli Lilly and Co (LLY.US)$ Up 0.09%, $Berkshire Hathaway-B (BRK.B.US)$ Rose by 0.55%.

$Oracle (ORCL.US)$ Closed down 1.32%, $Qualcomm (QCOM.US)$ Dropped by 0.79%, $Broadcom (AVGO.US)$ Fell by 0.78%, $Netflix (NFLX.US)$ Down 0.34%, $Adobe (ADBE.US)$ Fell by 0.18%, $Salesforce (CRM.US)$ Rose by 0.06%.

The mining sector collectively fell, $First Majestic Silver (AG.US)$ Fell by 4.13%, $Newmont (NEM.US)$ Fell by 5.64%. Lithium giant $Albemarle (ALB.US)$ Also fell by 3.62%.

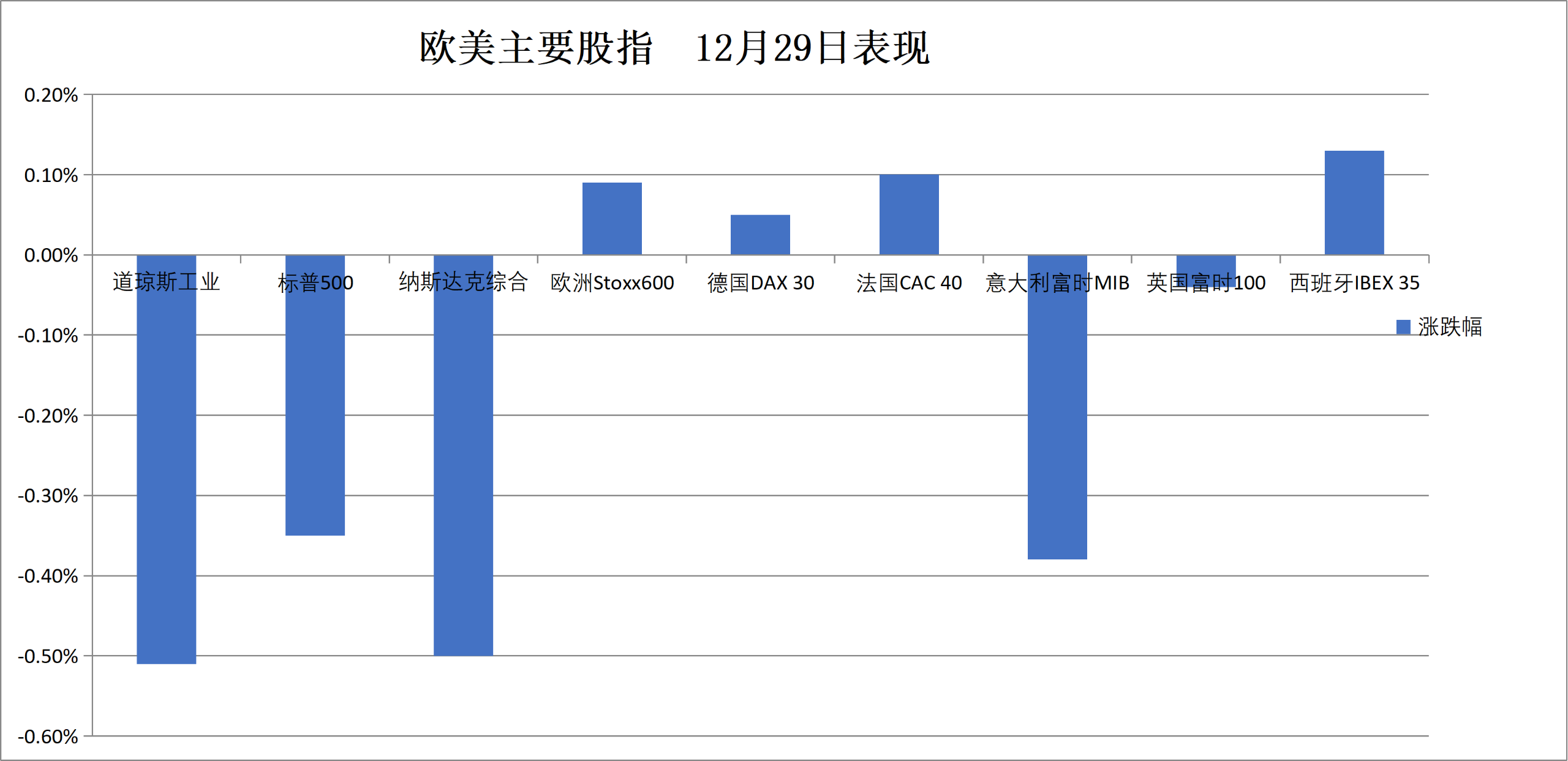

European stock markets closed at a record high, as investors kept an eye on the situation in Ukraine. Spain's benchmark index rose over 0.1%, hitting a new all-time closing high, while Italy’s banking sector dropped more than 0.6%.

Pan-European Indices:

The European STOXX 600 Index closed up 0.09% at 589.25 points, setting a new record high for the second consecutive trading day.

The Eurozone STOXX 50 Index rose 0.10% to close at 5751.71 points.

National indices:

The German DAX 30 Index closed up 0.05% at 24,351.12 points.

The French CAC 40 Index closed up 0.10% at 8,112.02 points.

The UK FTSE 100 Index closed down 0.04% at 9,866.53 points.

European individual stocks:

Among blue-chip stocks in the Eurozone, Adidas closed up 2.34%, Bayer rose 1.32%, and BASF SE gained 1.31%, ranking third in performance.

Among all components of the European STOXX 600 Index, Vend Marketplace surged 4.35%, Randstad rose 4.01%, B&M European Value Retail finished up 3.82%, and Orsted AS advanced 3.24%, ranking fourth in performance.

US crude oil futures settled up over 1.8%, while natural gas in New York rose more than 7.3%.

Crude oil:

WTI crude oil futures for February delivery settled up $1.05, or 1.84%, at $58.08 per barrel.

Middle East Abu Dhabi Murban crude oil futures rose 1.94%, closing at $62.48 per barrel.

Natural Gas:

NYMEX January natural gas futures closed up 7.35% at $4.6870 per million British thermal units.

Looking to pick stocks or analyze them? Want to know the opportunities and risks in your portfolio? For all investment-related questions,just ask Futubull AI!

Editor/KOKO