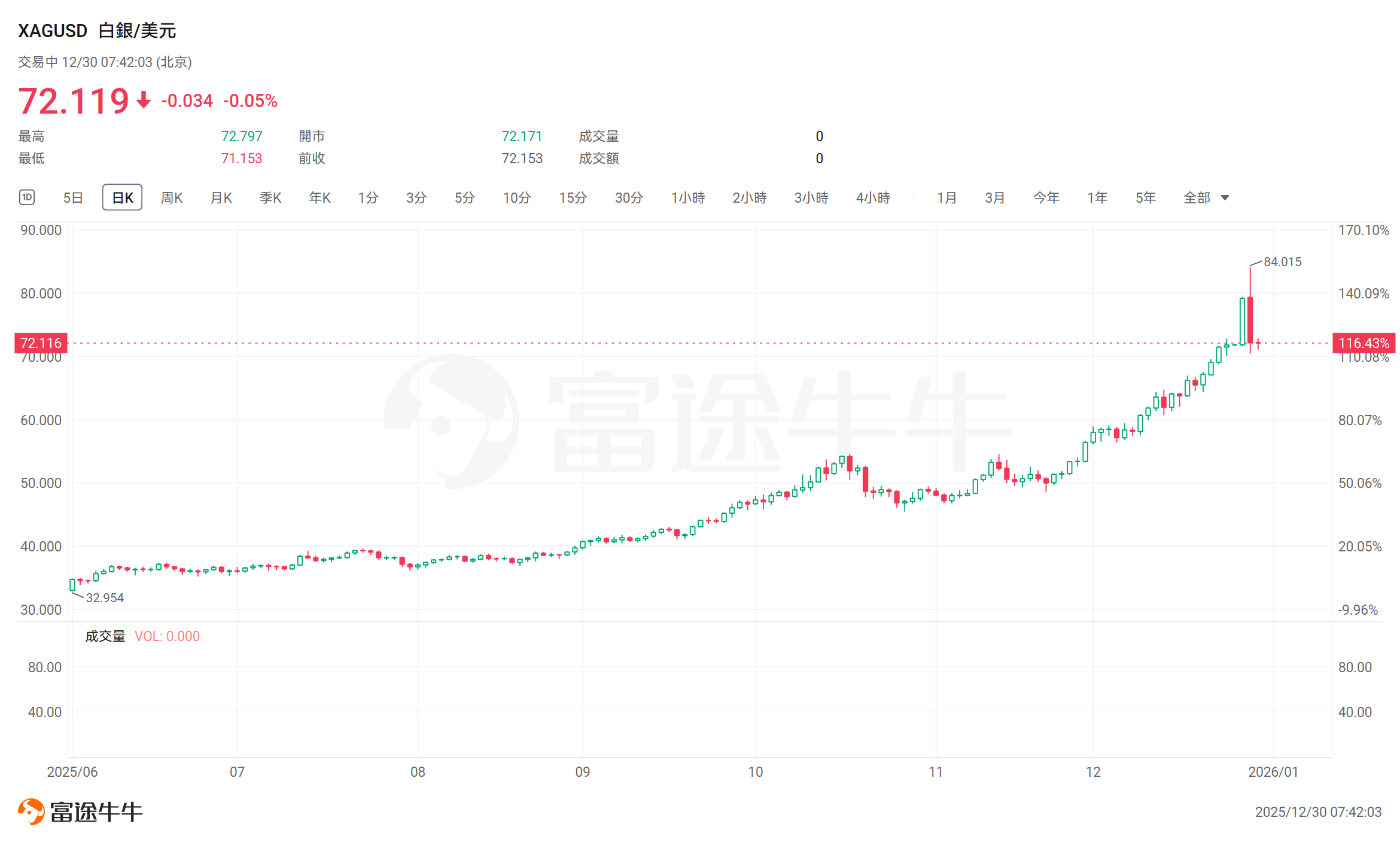

Silver prices surged to a record high above $84 per ounce in early trading on Monday but plummeted to near $70 amid thin post-holiday trading, marking one of the largest price reversals in the metal's history.

In recent days, the unusual volatility in silver has drawn significant attention — even figures like Elon Musk have taken notice of the metal's fierce rally to historic highs.

During Monday's early trading session,$XAG/USD (XAGUSD.FX)$Prices soared to a record level above $84 per ounce before rapidly crashing to near $70 in thin post-holiday trading. This represents one of the largest price reversals in the history of silver.

Year-to-date, the price of silver has risen by approximately 140%. The key question now is: where will silver go from here?

Year-to-date, the price of silver has risen by approximately 140%. The key question now is: where will silver go from here?

Below are the key charts for observing the silver market, used to assess subsequent movements.

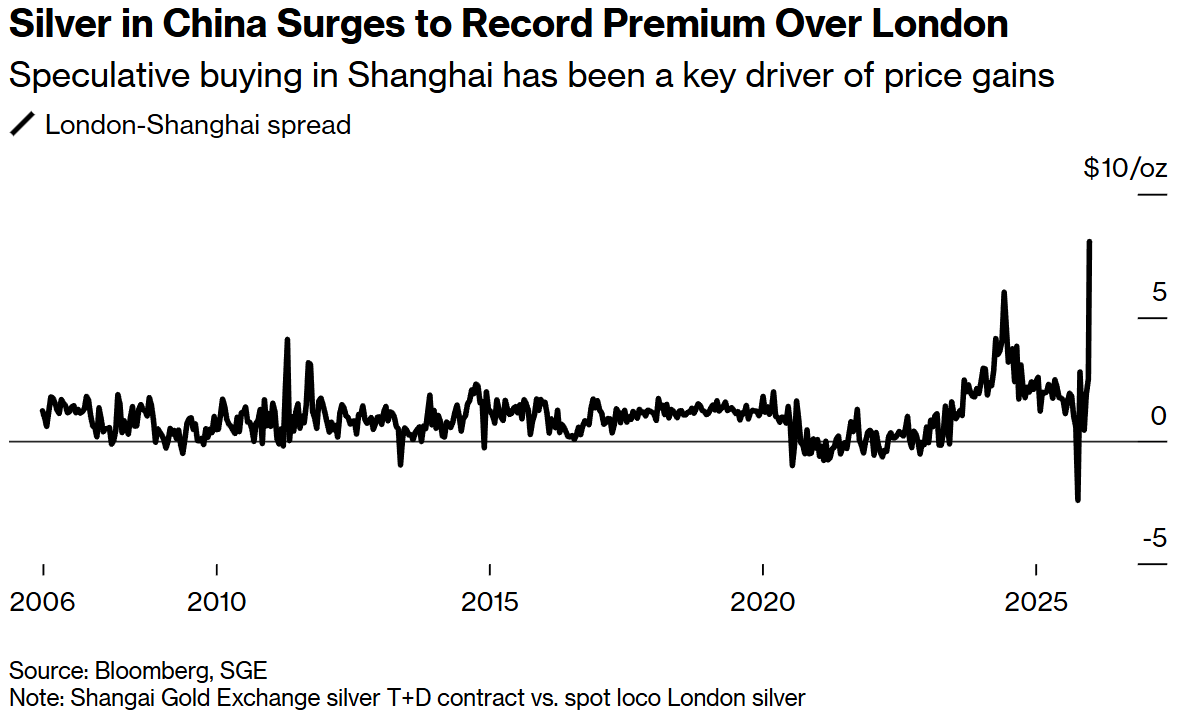

Chinese buying

The surge in interest from Chinese investors has been the primary driver behind the recent rise in silver prices. Speculators have flocked to purchase the precious metal, mirroring dynamics seen in the platinum market. In December, purchases of silver contracts on the Shanghai Gold Exchange climbed, pushing premiums to all-time highs and driving up other international benchmark prices.

After multiple risk warnings were ignored, this fierce rally forced the sole pure silver fund in China to reject new clients last week. The fund manager announced this unusual step last Friday. Previous measures, ranging from tightening trading rules to issuing cautionary advice regarding “unsustainable” gains, had all failed to quell investment fervor fueled by social media.

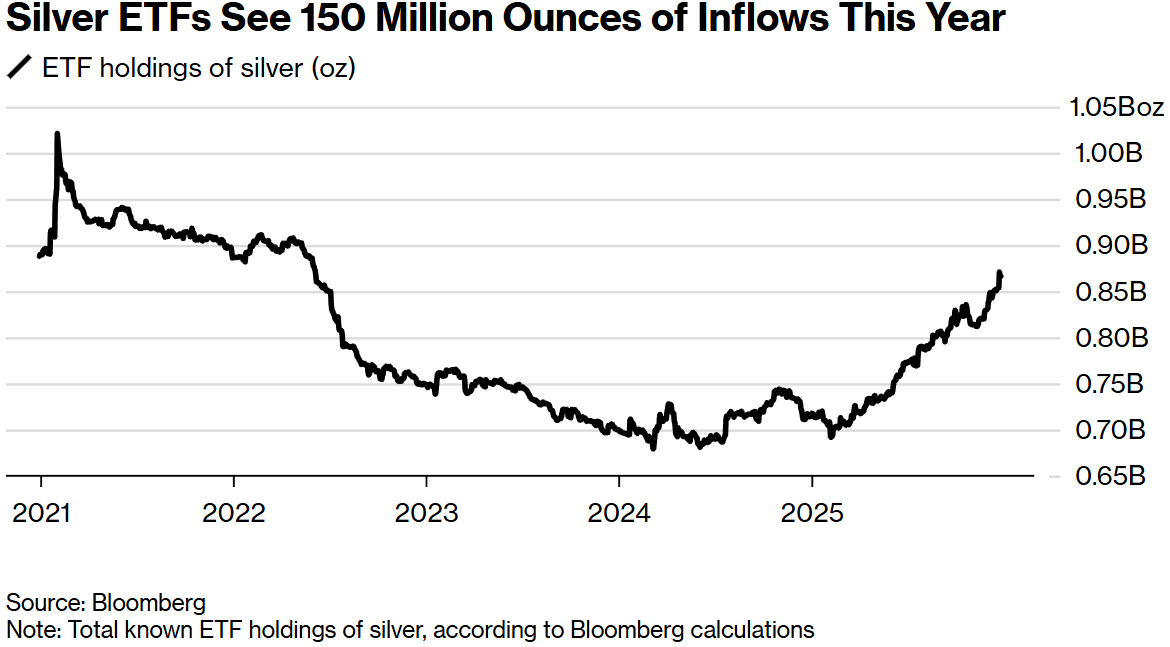

ETF inflows

This year, holdings in physically-backed silver exchange-traded funds (ETFs) have surged, increasing by more than 150 million ounces. Although the total amount of metal held by these funds remains below the peak reached during the 2021 Reddit-driven retail investment frenzy, the inflows have played a critical role in tightening an already strained market supply. According to calculations, these funds' holdings have increased month-over-month for all but one month this year.

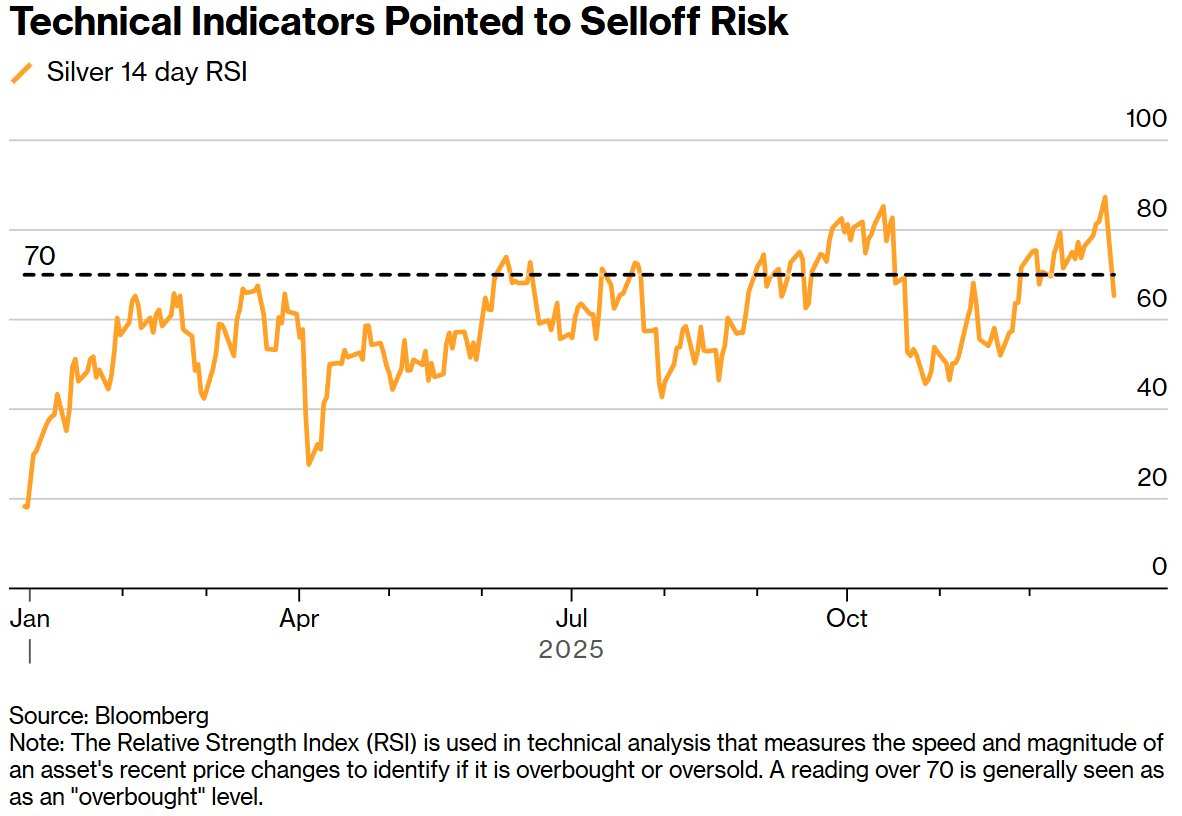

Technical indicators and margin requirements

In December alone, silver prices rose by more than 25%, putting it on track for the largest monthly gain since 2020. Such a rapid ascent means that some technical indicators are signaling that prices have risen too fast and too high. The Relative Strength Index (RSI) for silver — which measures buying and selling momentum — has remained above 70 for most of the past few weeks. A reading above 70 typically indicates that too many investors have bought the asset in a short period.

Some exchanges are taking steps to manage risk amid heightened volatility. According to a statement by CME Group, margins for certain Comex silver futures contracts will be raised starting Monday. This increases market resistance as traders need to commit more capital to maintain their positions. Some speculators, unwilling to do so, have been forced to scale back or close their positions.

Options Frenzy

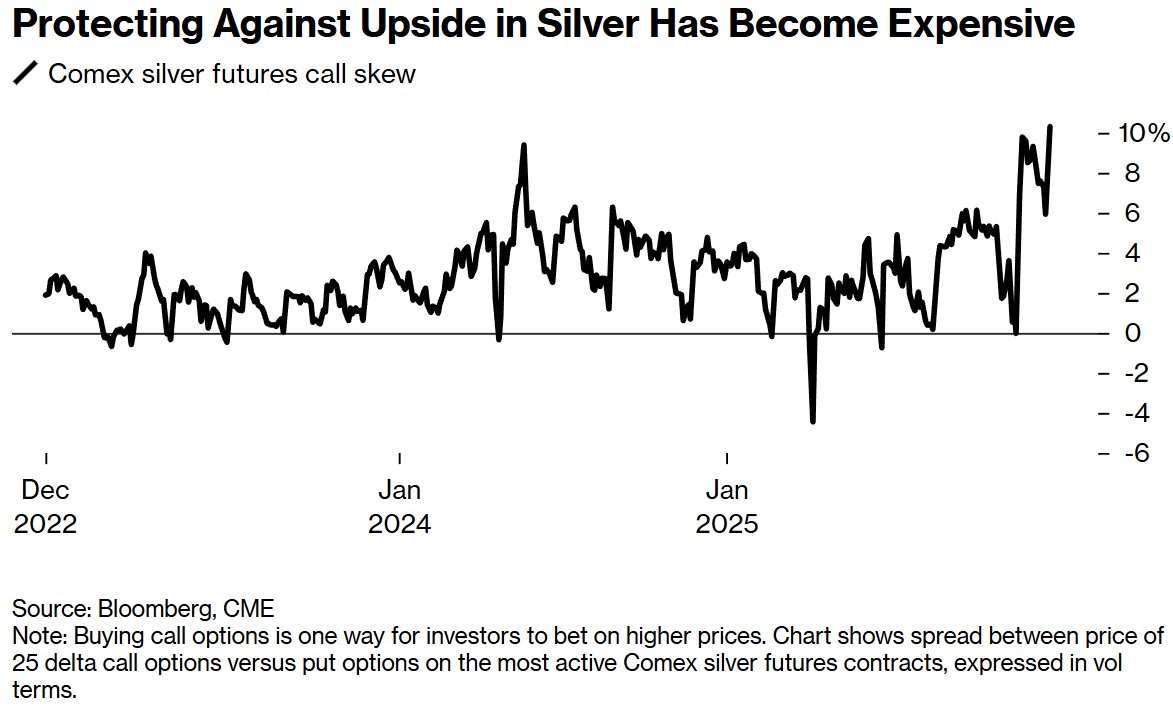

One sign of speculative fervor is the elevated level of purchases of bullish options on silver futures and related ETFs. Call options give buyers the right to purchase securities at a predetermined price and are often viewed as a cost-effective way to bet on market gains.

For the largest silver ETF—$iShares Silver Trust (SLV.US)$—the total open interest in bullish call options reached its highest level since 2021 this week. The cost of purchasing call options on silver futures also surged to an all-time high in recent weeks compared to put options used to hedge against price declines.

Borrowing Costs

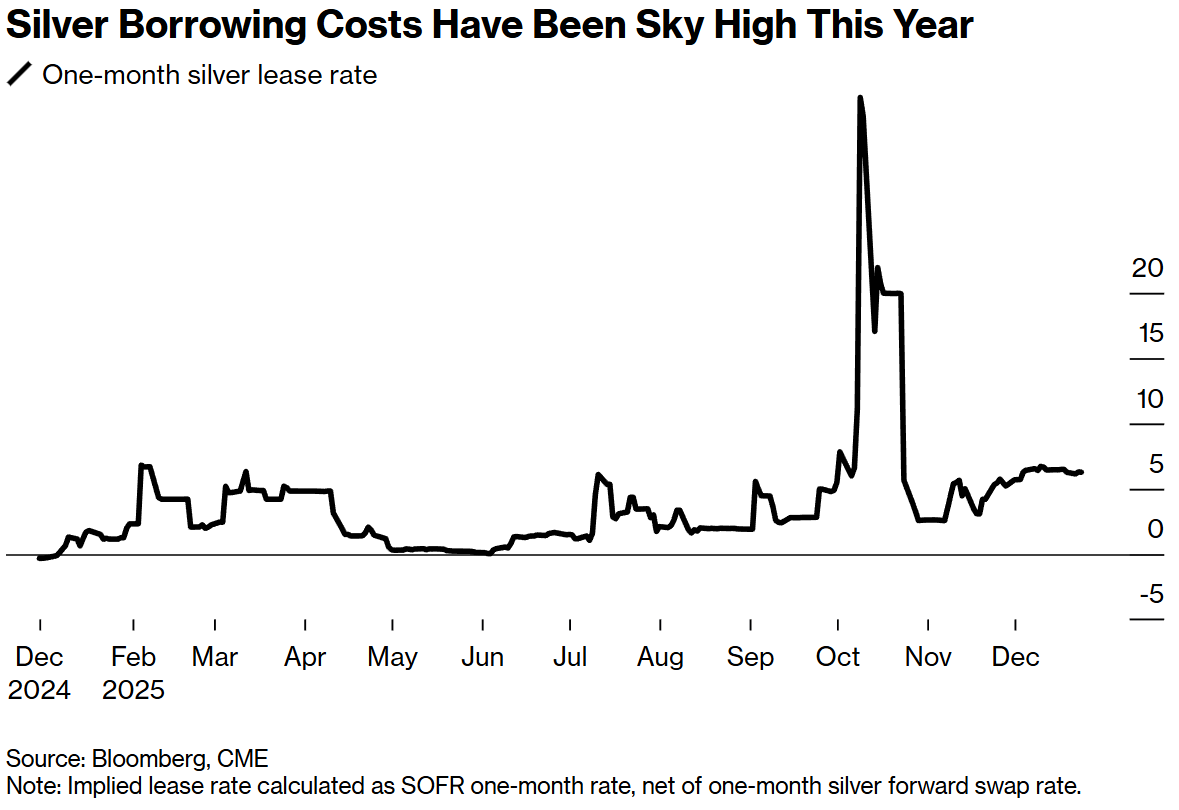

Due to tariff-related trade factors, most of the globally available silver remains stored in New York warehouses. Meanwhile, the market is still awaiting the results of the U.S. 'Section 232 Investigation' on critical minerals, which could lead to tariffs or other trade restrictions on the metal.

The influx of metals into the United States caused the London market to fall into a full-fledged 'short squeeze' in October, and borrowing costs in the London market remain significantly higher than the near-zero normal levels. This sets the stage for heightened volatility and frequent price spikes.

Catching Up with Gold

Precious metals investment demand has surged this year, supported by a weaker dollar, President Donald Trump’s aggressive moves to reshape global trade, and threats to the Federal Reserve’s independence.

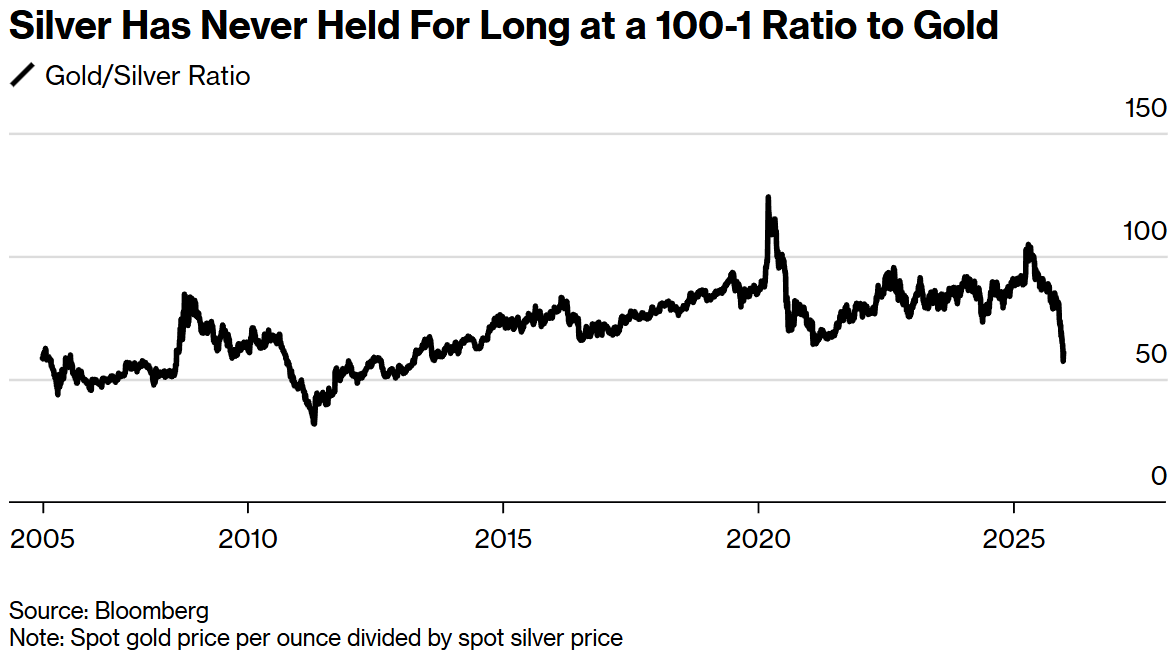

Gold rebounded first and additionally benefited from robust buying by central banks globally. Some market observers follow a rule of thumb: when gold makes a decisive move, silver eventually moves twice as far in the same direction—and indeed, they were correct this year.

Many investors also track the ratio between these two commodities. After gold initially surged at the beginning of the year, the gold-to-silver ratio expanded beyond 100:1, signaling to some a buying opportunity for silver. However, this ratio has rapidly declined in recent weeks.

Looking to pick stocks or analyze them? Want to know the opportunities and risks in your portfolio? For all investment-related questions,just ask Futubull AI!

Editor/KOKO