The global artificial intelligence (AI) wave, which has attracted hundreds of billions of dollars in financing and strategic partnerships, is now driving a wave of mergers and acquisitions in the data center industry.

The global artificial intelligence (AI) boom, which has attracted hundreds of billions of dollars in financing and strategic partnerships, is now driving a wave of mergers and acquisitions in the data center industry.

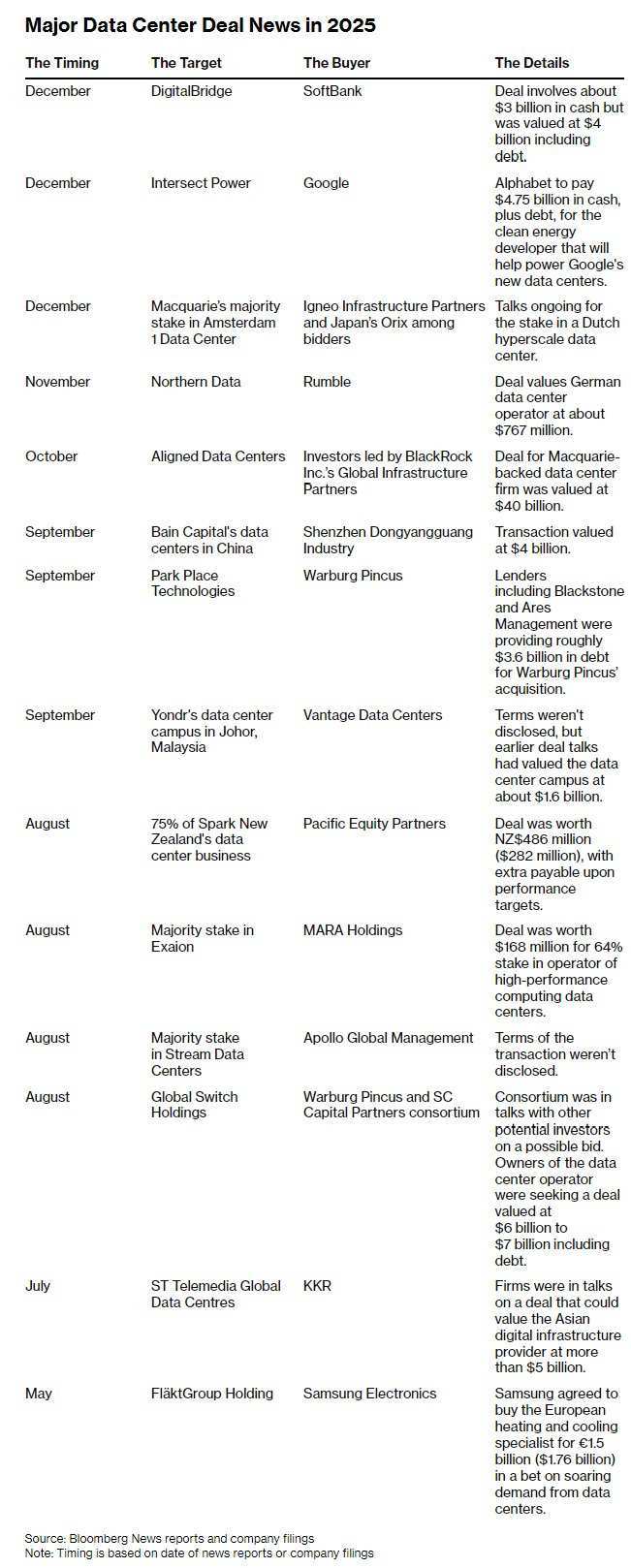

On Monday,$SoftBank Group (9984.JP)$has become the latest company to join the fray, announcing a multi-billion-dollar acquisition agreement with digital infrastructure investor $DigitalBridge Group (DBRG.US)$ , pushing the total value of global data center M&A deals this year past $700 billion. Below is an overview of this year's M&A activities related to data centers.

Including related investments, global data center transaction volumes have reached a record high this year.

Including related investments, global data center transaction volumes have reached a record high this year.

Despite growing investor caution over AI valuation bubbles and the financing risks behind the rapid expansion of data centers, this growth momentum remains strong. Concerns about AI-induced bubbles persist, leading to a sell-off in global equity markets in November.

Hyperscale enterprises are increasingly turning to private equity markets for financing instead of bearing the high costs of infrastructure construction themselves, resulting in a surge in debt financing and pushing transaction volumes to new highs.

This trend has raised concerns among some investors, who have begun to question the actual value of advanced technologies supported by data centers. Earlier this month, it was reported that$Blue Owl Capital (OBDC.US)$withdrew from a deal to support a $10 billion data center in Michigan, which temporarily caused$Oracle (ORCL.US)$'s stock price to fall.

S&P data shows that debt issuance in 2025 surged from $920 billion last year to $1.82 trillion, nearly doubling. $Meta Platforms (META.US)$ and $Alphabet-C (GOOG.US)$ has become one of the most active issuers, with Meta issuing $62 billion in bonds since 2022 — nearly half of which were issued in 2025 alone.

However, many analysts remain optimistic about the sector. ING Groep predicts healthy investment growth will continue into 2026, driven by advancements in AI technology and increased support for digital innovation from both public and private sectors.

Wim Steenbakkers, Global Head of Data Centers and Technology at ING Groep, stated: 'The development of AI has two sides: on one hand, it brings optimistic prospects such as accelerated pharmaceutical research; on the other hand, it raises concerns about (public) safety.'

Therefore, uncertainties remain regarding the profitability and business models of this technology. Questions about substantial investments can only be answered when future uncertainties diminish, and the application and benefits of the technology become clearer.

According to data from S&P Global Market Intelligence, more than 100 data center transactions have occurred in the first 11 months of this year, with their total value already surpassing the annual transaction volume for 2024. The majority of these transactions took place in the United States, followed by the Asia-Pacific region.

Iuri Struta, a TMT analyst at the firm, noted: 'The growth rate of data center construction in Europe is expected to be lower than in other regions, but it remains to be seen whether this will trigger a wave of mergers and acquisitions amid asset scarcity.'

A recent report by ING Groep stated that the pace of growth in the United States is leaving Europe 'far behind' and predicted that U.S. data center investments could be five times those in Europe. Meanwhile, the Middle East is increasingly becoming a new growth driver as wealthy Gulf states aim to position themselves as the next-generation global AI hubs.

Struta anticipates that M&A investment activities in the data center sector will become even more 'active' in 2026. He remarked, 'I would not be surprised if valuations, already high, climb further.'

‘New data center construction may face temporary limitations due to insufficient energy supply, which will make existing data centers more valuable. As large-scale data center enterprises remain scarce, we may see more non-core businesses selling off related assets.’

Editor/Rocky