Top News

Trump: Considering suing Powell on grounds of 'gross negligence'; the next Fed chair nominee may be announced in January.

On Monday local time, U.S. President Trump hinted that he already had a preferred candidate in mind for the next chair of the Federal Reserve but was not in a rush to make an announcement. At the same time, he once again mentioned that he might dismiss the current Fed Chair Powell and is considering filing a lawsuit against him for "gross incompetence" over an ongoing renovation project at the Federal Reserve. Trump stated that he would announce the Fed chair nominee at an appropriate time, emphasizing there was plenty of time, potentially making the announcement in January to replace Powell. During a press conference on Monday, when asked if he already had a favored candidate, Trump responded: Yes, I do, and it hasn't changed. I will announce at the right time; there is still ample time.

U.S. Pending Home Sales Hit Highest Level Since Early 2023 in November

The U.S. Pending Home Sales Index rose 3.3% month-over-month in November, surpassing expectations of a 1% increase, while the previous value was revised upward from 1.9% to 2.4%. The index for pending home sales increased by 2.6% year-over-year. The index tracking this metric reached its highest level since February 2023. Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), stated: Momentum among homebuyers is building. After adjusting for seasonal factors, the data shows this was the strongest performance of the year and the best since February 2023, nearly three years ago. Improvements in housing affordability—mainly driven by declining mortgage rates and wage growth outpacing home price increases—are encouraging buyers to enter the market. Meanwhile, compared to last year, more abundant housing inventory is also attracting more buyers into the market.

The U.S. Pending Home Sales Index rose 3.3% month-over-month in November, surpassing expectations of a 1% increase, while the previous value was revised upward from 1.9% to 2.4%. The index for pending home sales increased by 2.6% year-over-year. The index tracking this metric reached its highest level since February 2023. Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), stated: Momentum among homebuyers is building. After adjusting for seasonal factors, the data shows this was the strongest performance of the year and the best since February 2023, nearly three years ago. Improvements in housing affordability—mainly driven by declining mortgage rates and wage growth outpacing home price increases—are encouraging buyers to enter the market. Meanwhile, compared to last year, more abundant housing inventory is also attracting more buyers into the market.

Next week, the "Tech Spring Festival Gala" CES opens, and companies like NVIDIA must prove to the market that AI can drive sales.

The annual Consumer Electronics Show (CES) is set to kick off next week in Las Vegas, where tech giants such as NVIDIA, Samsung, and Lenovo will face a critical test: proving to ordinary consumers that AI hardware is worth purchasing. This annual technology event will no longer be limited to conceptual showcases but will serve as an important litmus test for real market demand for AI products. Companies need to demonstrate to the market that AI can not only be "developed" but also "sold." During the CES exhibition held from January 6 to 9, NVIDIA CEO Jensen Huang will showcase foundational AI technologies, while companies like Samsung, Lenovo, and AMD will unveil numerous consumer-grade products with AI as their core selling point.

Nomura: Surprisingly strong AI demand expected to drive a supercycle in memory that will last at least until 2027.

Nomura believes that due to unexpectedly strong demand for DRAM from AI servers and a surge in demand for enterprise solid-state drives (eSSD), the global memory industry’s "super cycle" will last longer than expected, with this upward trend projected to continue at least until 2027. Given that large-scale capacity expansion is not expected until 2028, supply-demand gaps will drive significant increases in DRAM prices. Nomura has raised its earnings forecasts for Samsung and SK Hynix, noting that the profitability of general-purpose memory has now matched or even exceeded that of High Bandwidth Memory (HBM).

China to Adjust Tariffs on Certain Goods Starting Next Year

The Tariff Commission of the State Council released the "2026 Tariff Adjustment Plan," which will take effect on January 1, 2026. To enhance the linkage between domestic and international markets and resources and expand the supply of high-quality goods, provisional import tariffs lower than the most-favored-nation (MFN) rates will be applied to 935 items starting in 2026.

MIIT Establishes Standardization Technical Committee for Humanoid Robots and Embodied Intelligence

According to media reports, the establishment meeting of the Standardization Technical Committee for Humanoid Robots and Embodied Intelligence under the Ministry of Industry and Information Technology (referred to as the "Committee") was held in Beijing on the 26th. The Committee will primarily undertake the formulation and revision of industry standards in areas including fundamental commonalities, key technologies, components, complete systems, applications, and safety for humanoid robots and embodied intelligence. The Secretariat is located at the China Institute of Electronics. Yang Zhen, an analyst at Orient Securities, stated that leading companies in humanoid robots, such as Tesla, have recently demonstrated excellent motion control technologies. As the industry enters a rapid development phase, the market will increasingly focus on mass production progress.

U.S. Stock Market Recap

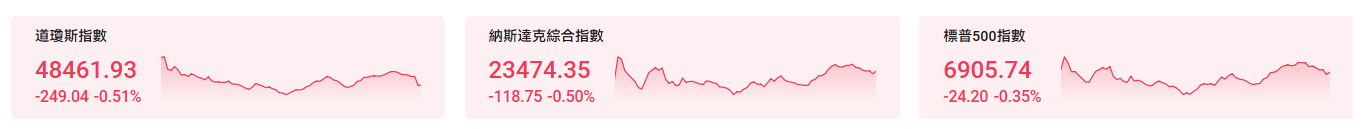

Precious Metals Surge Hits Market Sentiment; Three Major Indices Close Lower

Driven by the anxiety caused by significant fluctuations in commodities, the three major U.S. stock indexes collectively closed lower last night and this morning. By the close, the S&P 500 Index fell 0.35% to 6905.74 points; the Nasdaq Composite Index dropped 0.5% to 23474.35 points; and the Dow Jones Industrial Average declined 0.51% to 48461.93 points.

This week is also relatively light on economic events, with investors expecting the release of the Federal Reserve’s December meeting minutes on Tuesday (Wednesday morning Beijing time). The next important event will be the arrival of the New Year holiday.

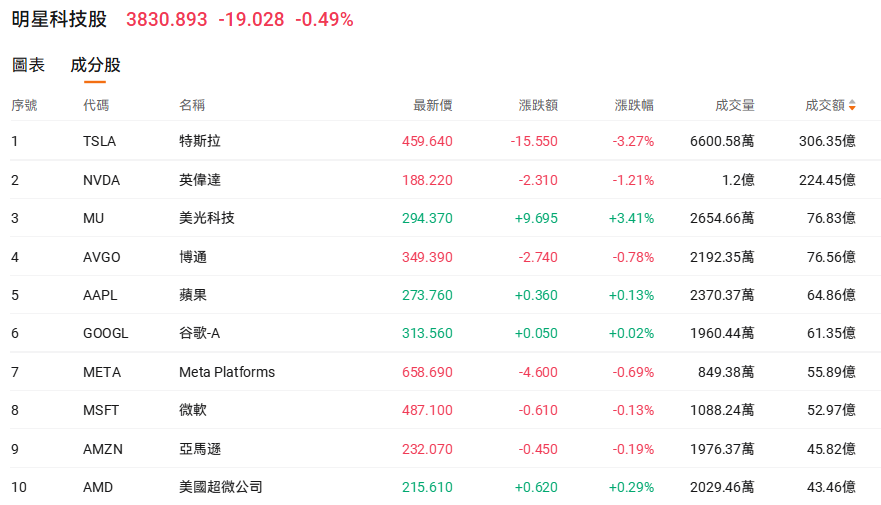

Among leading tech stocks, NVIDIA fell 1.21%, Apple gained 0.13%, Google-A rose 0.02%, Microsoft dropped 0.13%, Amazon slipped 0.19%, Meta Platforms declined 0.69%, Broadcom fell 0.78%, Taiwan Semiconductor Manufacturing fell 0.63%, and Tesla dropped 3.27%.

Chinese concept stocks weakened amid volatility on Monday. Alibaba fell 2.46%, JD.com declined 0.44%, Baidu gained 1.61%, PDD Holdings dropped 0.75%, Bilibili fell 1.24%, Nio surged 4.71%, NetEase increased 0.92%, Li Auto fell 1.61%, XPeng Motors slipped 1.35%, and EHang declined 2.37%.

Gold and silver prices continued to drop, with Newmont, Gold Fields, and several other companies falling over 6%.

Tesla fell more than 3%. The repeated delays of the Cybertruck have led to a significant reduction in orders for high-nickel battery materials.

$Tesla (TSLA.US)$ The ongoing delays of the Cybertruck project have impacted its supply chain. South Korean battery material supplier L&F disclosed on Monday that its supply contract with Tesla, signed in February 2023 for 3.83 trillion Korean won, has been drastically cut to 9.73 million Korean won, representing a 99% reduction due to changes in delivery volumes. The material was originally intended for the Cybertruck battery, but model delays and shifting consumer preferences have sharply reduced actual demand. Additionally, policy changes such as the Inflation Reduction Act have also affected Tesla’s procurement plans.

Meta announced the acquisition of AI agent company Manus, marking Meta's third-largest acquisition since its inception.

$Meta Platforms (META.US)$ Meta announced the acquisition of AI agent company Manus to accelerate artificial intelligence innovation, though specific terms of the deal were not disclosed. According to LatePost, Meta acquired Butterfly Effect, the developer of AI application Manus, for billions of dollars. This marks Meta’s third-largest acquisition since its founding, surpassed only by WhatsApp and Scale AI. Prior to Meta’s acquisition, Manus was raising a new round of funding at a $2 billion valuation. Meta stated that Manus' talent would join the team, and the company will continue operating and selling Manus services, integrating them into Meta’s products.

Amazon's performance this year has been the weakest among the seven major tech giants, but Wall Street is optimistic about a significant rise in its stock price next year.

$Amazon (AMZN.US)$ The stock’s performance in 2025 has been lackluster. The e-commerce and cloud computing giant’s share price has risen just 6% year-to-date, significantly underperforming the S&P 500 Index, which has gained 18% during the same period, making it the worst performer among the 'Magnificent Seven.' For comparison, Google, the best-performing stock in the group, has surged 66% this year, driven by optimistic expectations surrounding its next-generation Gemini 3 model. Analysts noted that the slowdown in sales growth of Amazon Web Services (AWS) and mixed market sentiment regarding the company’s artificial intelligence (AI) commercialization capabilities are key factors contributing to investor uncertainty. Nonetheless, Wall Street remains supportive of Amazon, with some institutions even listing it as a top pick for 2026.

SoftBank to Acquire Data Center Company DigitalBridge for $4 Billion

$SoftBank Group (ADR) (SFTBY.US)$ Agree to acquire the private equity firm $DigitalBridge Group (DBRG.US)$ , valuing the data center investor at $4 billion including debt. In a statement released on Monday, the Japanese conglomerate said it would acquire New York-listed DigitalBridge for $16 per share in cash as part of SoftBank's push to invest in digital infrastructure amid the AI boom. The two companies stated that the transaction represents a 15% premium over DigitalBridge's closing price on December 26. The deal is expected to close in the second half of 2026, subject to regulatory approval.

Novo-Nordisk A/S reduces pricing of semaglutide in China

According to Yicai, recent updates on pharmaceutical procurement platforms across multiple provinces indicate a price reduction for the imported weight-loss drug semaglutide injection. This price adjustment results from the manufacturer’s $Novo-Nordisk A/S (NVO.US)$ voluntary price cut, with some e-commerce platforms also adjusting their product prices accordingly. With Novo-Nordisk A/S's patent for semaglutide in China set to expire in March this year, several local companies are preparing to launch cheaper generic versions of the drug.

Lululemon is embroiled in a rare power struggle.

Well-known athletic apparel retailer, embroiled in management challenges, $Lululemon Athletica (LULU.US)$ is facing an unprecedented power struggle: company founder Chip Wilson has launched a campaign to oust the current board of directors. In his statement, Wilson emphasized that Lululemon Athletica requires visionary and creative leadership to ensure sustained growth, qualities he believes the current board members lack. He pointed out that introducing new leadership is essential to redefining Lululemon and ushering in the next phase of its success.

Top 20 by Trading Value

Market Outlook

Northbound funds reduce Hong Kong stock holdings by over HK$3.4 billion; nearly HK$1 billion invested in China Merchants Bank, while over HK$1.4 billion worth of shares sold in China Mobile

On Monday, December 29, southbound funds recorded a net sell-off of HK$3.414 billion worth of Hong Kong stocks.

$CM BANK (03968.HK)$、$HUA HONG SEMI (01347.HK)$、$JIANGXI COPPER (00358.HK)$Net inflows reached HK$971 million, HK$262 million, and HK$22.59 million respectively;

$CHINA MOBILE (00941.HK)$、$BABA-W (09988.HK)$、$ZIJIN MINING (02899.HK)$Were net sold HKD 1.45 billion, HKD 1.024 billion, and HKD 622 million respectively.

SMIC: Plans to Acquire 49% Stake in SMIC Northern for RMB 40.6 Billion

$SMIC (00981.HK)$ The announcement stated that the company plans to issue shares to five shareholders of SMIC Northern, including the National Integrated Circuit Fund, to acquire their 49.00% stake in the target company for RMB 40,600,910,000. Upon completion of the transaction, SMIC will hold 100.00% of SMIC Northern’s shares, making it a wholly-owned subsidiary. SMIC Northern primarily provides customers with 12-inch integrated circuit wafer foundry services and related solutions across various process platforms. This transaction is expected to further improve the quality of the listed company's assets, enhance business synergy, and promote its long-term development. The main business scope of the listed company will remain unchanged before and after the transaction.

Leapmotor: 4.139 million H-shares unlocked under the incentive plan will be sold opportunistically in the secondary market.

$LEAPMOTOR (09863.HK)$ According to the announcement, Ningbo Jinghang is an employee incentive platform of the company, holding 12,806,500 H-shares of the company. Its managing partner is Mr. Zhu Jiangming. As per the incentive plan, 4,138,950 H-shares have been unlocked, and this portion of shares will be sold in the secondary market at an appropriate time based on the requirements of the incentivized individuals. After the reduction, Mr. Zhu Jiangming, Mr. Fu Liquan, and the largest single shareholder group collectively hold 204,961,588 H-shares and 128,517,839 domestic shares of the company, representing 23.45% of the total issued shares of the company.

Today's Focus

Keywords: U.S. December Chicago PMI, Hong Kong stock listings such as Insilico Medicine and QoHome Robotics

In terms of economic data, the December Chicago PMI figures can be monitored.

22:00 U.S. FHFA House Price Index month-over-month rate for October

22:45 U.S. December Chicago PMI

In terms of new stocks, six companies simultaneously rang the bell on the Hong Kong Stock Exchange on December 30. These six companies include 'a provider of home robotics systems.' $ONEROBOTICS (06600.HK)$ a 'supplier of real-time data infrastructure and analytics solutions', $XUNCE (03317.HK)$ the 'first Physical AI stock' under Chapter 18C, $51WORLD (06651.HK)$ an 'AI-driven drug discovery and development enterprise', $INSILICO (03696.HK)$ a 'provider of prefabricated steel structure building subcontracting services', $USAS BUILDING (02671.HK)$ and a 'premium domestic skincare brand in China'. $FOREST CABIN (02657.HK)$ 。

![]()

Morning Reading by Niuniu:

The smaller the trading volume when the price begins to rise, the more optimistic the situation is.

——André Kostolany

![]() AI Portfolio Strategist goes live!Gain comprehensive insights into your holdings, fully grasp opportunities and risks with a single click.

AI Portfolio Strategist goes live!Gain comprehensive insights into your holdings, fully grasp opportunities and risks with a single click.

Editor/Rocky