Regarding this pullback, the Goldman Sachs Asia trading desk noted that there is no 'compelling reason to short the market.' Market analysts generally believe that the sharp correction in prices was jointly driven by scarce liquidity during the holiday period, exchanges raising margin requirements, and technical indicators signaling extreme overbought conditions.

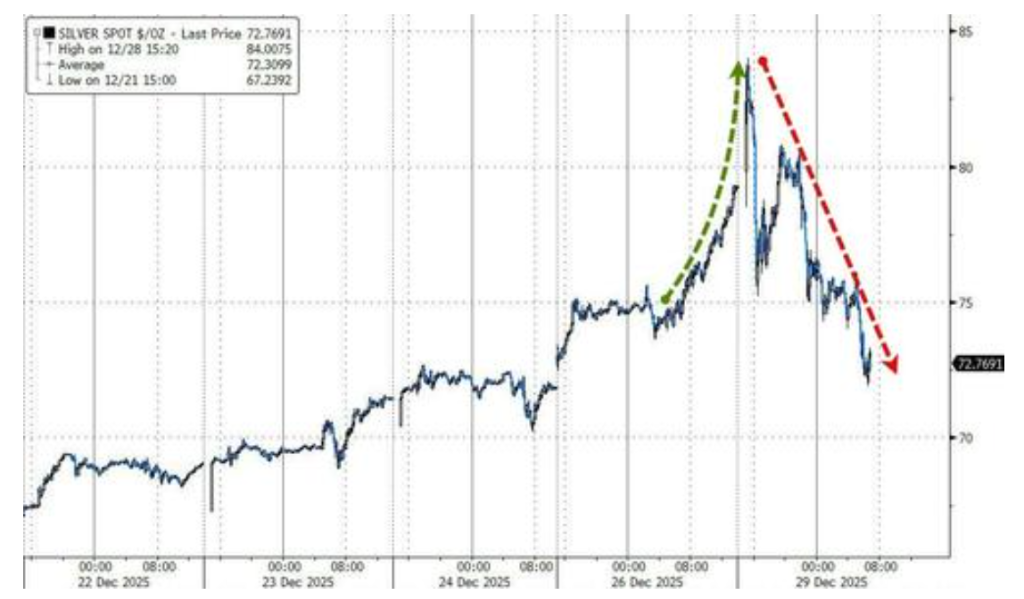

$XAG/USD (XAGUSD.FX)$ Prices plunged sharply after breaching the $80 per ounce mark for the first time, bringing an end to the recent near-vertical upward trend. Despite the market experiencing significant volatility, traders struggled to identify a single clear catalyst for the crash, as extreme market sentiment faced a correction.

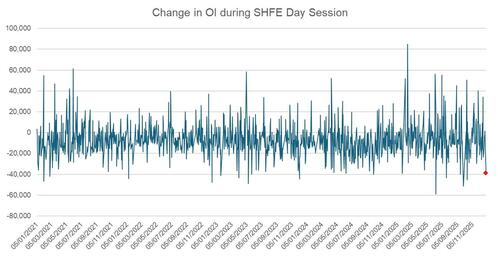

In overnight trading on Monday, silver prices surged above $84 before experiencing a steep drop, erasing nearly all early gains and closing up just 0.51%. Meanwhile, the entire precious metals sector came under pressure, with platinum and palladium both hitting their daily downside limits, while gold fell by 0.91%. Open interest in the four major precious metals contracts declined across the board.

This reversal occurred against the backdrop of surging investment demand in China. The premium of Shanghai spot silver over London prices once exceeded $8, reaching an all-time high. In response to the frenzied market sentiment, China's sole pure silver fund was forced to take the drastic measure of rejecting new clients after issuing multiple risk warnings that proved ineffective.

This reversal occurred against the backdrop of surging investment demand in China. The premium of Shanghai spot silver over London prices once exceeded $8, reaching an all-time high. In response to the frenzied market sentiment, China's sole pure silver fund was forced to take the drastic measure of rejecting new clients after issuing multiple risk warnings that proved ineffective.

Regarding this pullback, the Goldman Sachs Asia trading desk noted that there is no 'compelling reason to short the market.' Market analysts generally believe that the sharp correction in prices was jointly driven by scarce liquidity during the holiday period, exchanges raising margin requirements, and technical indicators signaling extreme overbought conditions.

Lack of a clear short-selling rationale

Despite the intense market fluctuations, institutions remained cautious about pinpointing specific reasons for the downturn.

The Goldman Sachs Asia trading desk noted that with only three days left until the New Year, China’s commodities markets remained highly volatile. Silver surged 9.25% before midday trading but subsequently shifted into risk-off mode without any apparent negative news, triggering a significant pullback across the precious metals sector.

Bloomberg macro strategist Adam Linton agreed with Goldman Sachs' view that no single trigger factor existed. He pointed out that although there was no clear driver behind silver's correction, low liquidity and its previous parabolic rise made it highly susceptible to a reversal.

Macro drivers and liquidity remain weak, suggesting that this unstable price movement in metal markets could become the norm for the remainder of 2025.

Speculative fervor meets regulatory intervention

Speculative sentiment has been identified as a key driver of recent price action. Wang Yanqing, an analyst at China Futures Ltd., stated that the speculative atmosphere is extremely strong, and speculation surrounding tight physical supplies has reached somewhat extreme levels.

The tightening at the regulatory level is having a cooling effect on the market. A CME statement shows that margin requirements for certain Comex silver futures contracts will be increased starting from Monday, rising from $3.2 per ounce to $4.4. Wang Yanqing believes this move will help reduce speculative behavior. Additionally, the Guangzhou Futures Exchange (GFEX) has recently tightened measures to curb excessive trading in palladium and platinum.

Liquidity Drying Up and Technical Correction

Market structure and technical indicators also signal the need for a correction. The PFR ExtremeHurst model — a tool used to identify herd behavior triggering self-reinforcing frenzies — has triggered a top exhaustion signal for silver. A similar signal accurately predicted an 11% correction in gold back in October.

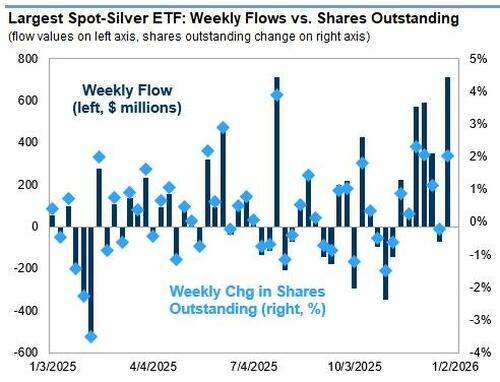

In terms of capital flows, Goldman Sachs futures trader Robbie Dwyer pointed out that there was a noticeable wave of liquidation in early trading on Monday, with 40,000 contracts sold throughout the day. Despite ETFs purchasing 13 million ounces of silver between December 19 and 26, this did not prevent profit-taking in the futures market. Dwyer emphasized that while the increase in margin requirements may have contributed to the selling, funds might have already begun reducing their long positions amid high volatility and elevated prices over the past week.

Editor/KOKO