The three major U.S. stock indexes closed collectively higher, $Dow Jones Index (.DJI.US)$ Up 1.21%, $Nasdaq(NDAQ.US)$ Up 1.18%, $S&P 500 Index (.SPX.US)$Up 1.16%.

Storage-related concept stocks performed strongly, $SanDisk Corp (SNDK.US)$ Surging over 10%, with cumulative gains exceeding 111% year-to-date in 2026; $Western Digital (WDC.US)$rose more than 8%,$Micron Technology (MU.US)$up over 6%.

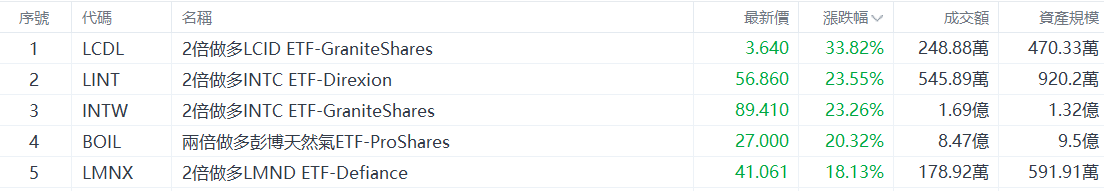

Top 5 Gainers in U.S. Equity ETFs

$2x Leverage LCID ETF-GraniteShares (LCDL.US)$ Rose by 33.82%, with a trading volume of $2.48 million.

$2x Leverage LCID ETF-GraniteShares (LCDL.US)$ Rose by 33.82%, with a trading volume of $2.48 million.

In terms of news, Rockwell Automation expanded its cooperation with Lucid to support electric vehicle manufacturing operations in Saudi Arabia using advanced software solutions.

$2x Leveraged INTC ETF - Direxion (LINT.US)$ Rose by 23.55%, with a trading volume of $5.45 million.

$2x Long INTC ETF-GraniteShares (INTW.US) Rose by 23.26%, with a trading volume of $16.9 million.

On the news front, Intel stated that its server CPU production capacity for the entire year of 2026 has been mostly sold out. The company plans to raise server CPU prices by 10-15%. Coupled with the upcoming release of earnings reports, the stock price continues to strengthen as a result.

ProShares Ultra Bloomberg Natural Gas ETF (BOIL.US) Up 20.32%, with a trading volume of 847 million US dollars.

On the news front, as widespread freezing weather sweeps across the United States and heating demand surges, the price of US natural gas futures has risen more than 50% in just two days. Specific market data shows that the main US natural gas futures contract rose over 25% on Tuesday, followed by another increase of over 21% on Wednesday, reaching a high of 4.95 US dollars per million British thermal units, the highest level since December 9 last year.

$2 times long LMND ETF-Defiance (LMNX.US) Up 18.13%, with a trading volume of 1.7892 million US dollars.

On the news front, Lemonade announced on Wednesday that it has launched auto insurance for autonomous vehicles, initially covering Tesla (TSLA) vehicles equipped with full self-driving (FSD) software.

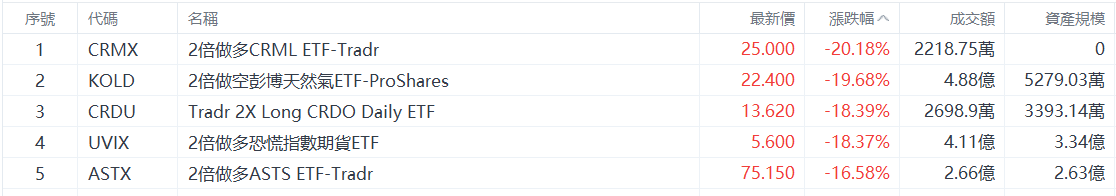

Top 5 Decliners on US Stock ETFs

$2x Leveraged CRML ETF-Tradr (CRMX.US)$ Down 20.18%, with a trading volume of 22.1875 million US dollars.

$2 times short Bloomberg Natural Gas ETF-ProShares (KOLD.US) Down 19.68%, with a trading volume of 488 million US dollars.

$Tradr 2X Long CRDO Daily ETF (CRDU.US)$ Down 18.39%, with a trading volume of 26.989 million US dollars.

$2x Long Volatility Index Futures ETF (UVIX.US)$ Down 18.37%, with a trading volume of 411 million US dollars.

$2x Leveraged ASTS ETF-Tradr (ASTX.US)$ Dropped 16.58%, with a trading volume of $266 million.

Top 5 Gainers in U.S. Large-Cap Index ETFs

$Direxion Daily Small Cap Bull 3X Shares (TNA.US)$ Rose 5.88%, with a trading volume of $796 million.

ProShares Short VIX Short-Term Futures ETF (SVXY.US) Rose 5.09%, with a trading volume of $191 million.

$ProShares UltraPro QQQ (TQQQ.US)$ Rose 3.94%, with a trading volume of $7.737 billion.

$ProShares Ultra Russell 2000 (UWM.US)$ Rose 3.88%, with a trading volume of $84.1955 million.

ProShares UltraPro Dow30 (UDOW.US) Rose 3.48%, with a trading volume of $258 million.

On the news front, U.S. President Trump canceled new tariffs targeting Europe and stated that a framework for an agreement on the future of Greenland and the entire Arctic region had been reached. Affected by this, all three major U.S. stock indexes closed more than 1% higher; the Russell 2000 Index surged 2% to hit a new high, with technology stocks leading the market rebound, and the Philadelphia Semiconductor Index rose over 3%.

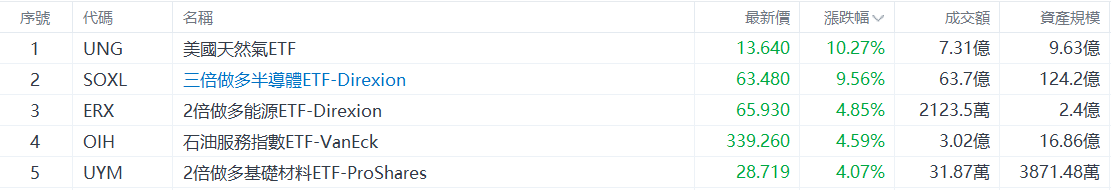

Top 5 Industry ETF Gainers

$US Natural Gas ETF (UNG.US)$ Rose 10.27%, with a trading volume of $731 million.

$Direxion Daily Semiconductor Bull 3X Shares (SOXL.US)$ Rose 9.56%, with a trading volume of $6.37 billion.

$2x Leveraged Energy ETF-Direxion (ERX.US)$ Rose 4.85%, with a trading volume of $21.235 million.

$Oil Services ETF-VanEck (OIH.US)$ Increased by 4.59%, with a trading volume of 302 million US dollars.

$2x Leveraged Basic Materials ETF-ProShares (UYM.US) Increased by 4.07%, with a trading volume of 318,700 US dollars.

Top 5 increases in bond-type ETFs

$Direxion Daily 20+ Year Treasury Bull 3X Shares (TMF.US)$ Increased by 2.28%, with a trading volume of 312 million US dollars.

ProShares Ultra 20+ Year Treasury (UBT.US) Increased by 1.53%, with a trading volume of 2.4894 million US dollars.

Emerging Markets Sovereign Debt - PowerShares (PCY.US) Increased by 1.03%, with a trading volume of 7.029 million US dollars.

$Vanguard Long-Term Corporate Bond ETF (VCLT.US)$ Increased by 0.92%, with a trading volume of 677 million US dollars.

$iShares Emerging Markets USD Bond ETF (EMB.US)$ Increased by 0.80%, with a trading volume of 1.541 billion US dollars.

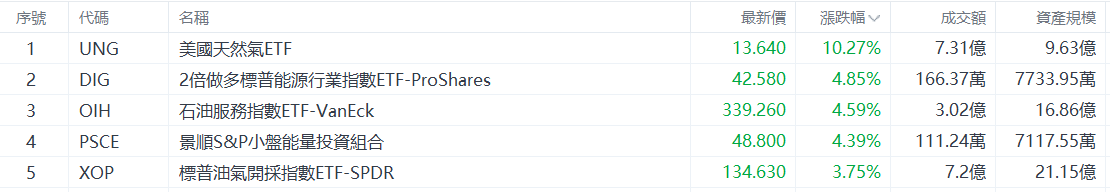

Top 5 Gainers in Commodity ETFs

$US Natural Gas ETF (UNG.US)$ Rose 10.27%, with a trading volume of $731 million.

$2x Leverage S&P Energy Sector ETF-ProShares (DIG.US) Increased by 4.85%, with a trading volume of 1.6637 million US dollars.

$Oil Services ETF-VanEck (OIH.US)$ Increased by 4.59%, with a trading volume of 302 million US dollars.

$Invesco S&P Small Cap Energy ETF(PSCE.US)$ Increased by 4.39%, with a trading volume of 1.1124 million US dollars.

SPDR S&P Oil & Gas Exploration & Production ETF (XOP.US) Increased by 3.75%, with a trading volume of 720 million US dollars.

How to choose ETFs?Smartly use tools to select high-quality ETFs.

Editor/Stephen