As Trump's erratic policies have frightened investors, funds are fleeing the dollar and rushing to the last 'safe haven'...

Gold is set for its best week in nearly six years after the Greenland crisis prompted investors, amid concerns over erratic White House policymaking, to seek a safe-haven alternative to the dollar, while the greenback suffered its worst week since June.

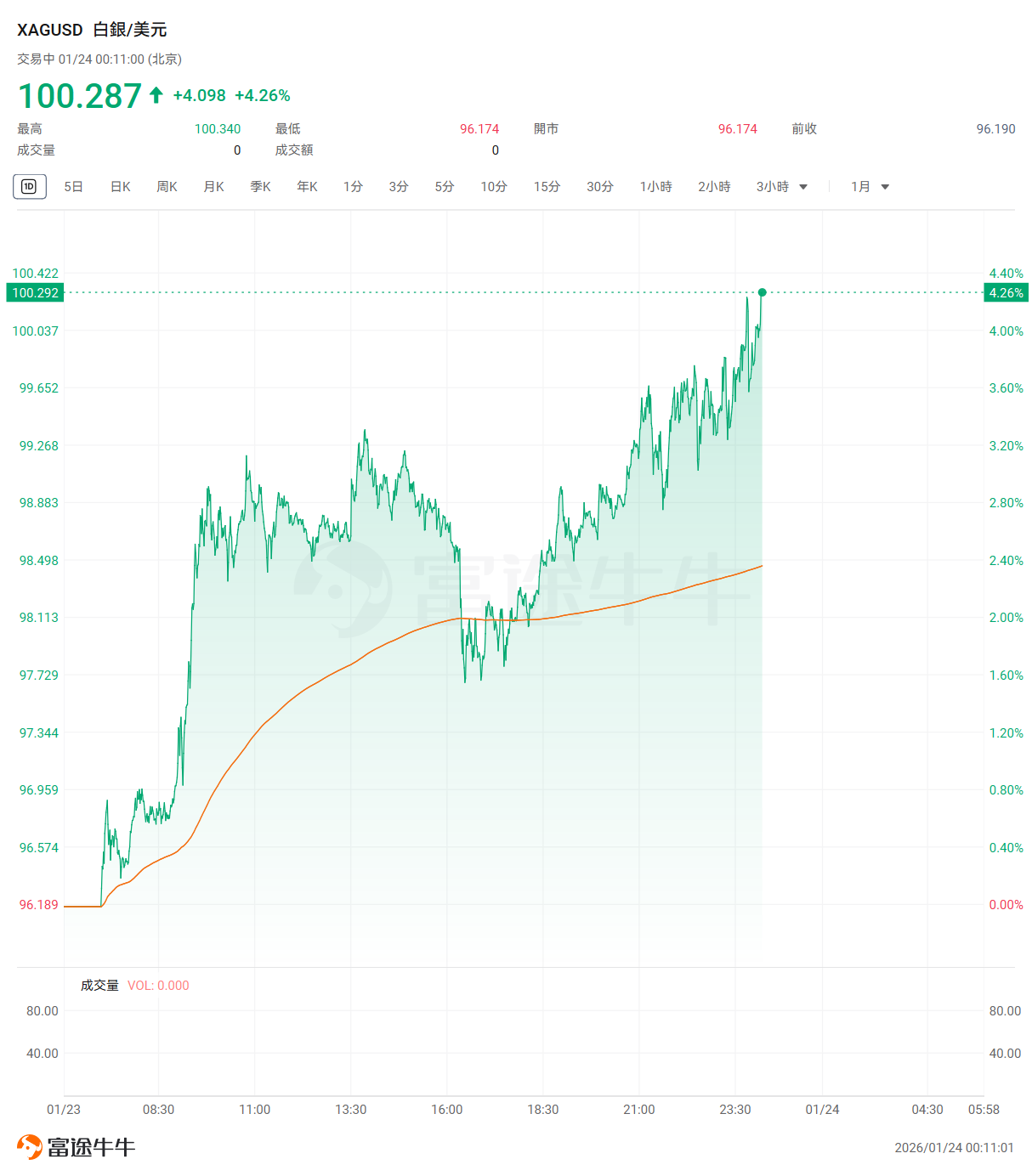

Gold hit a historic high of nearly USD 5,000 per ounce on Friday, while spot silver broke through the USD 100 per ounce mark for the first time, officially entering the 'triple-digit era.' In less than a month since the beginning of the year, its increase has approached 40%.

As of press time, the majority of U.S. gold and silver stocks had risen.$Blue Gold (BGL.US)$up more than 16%,$U.S. Gold Corp (USAU.US)$Surging over 7%,$Pan American Silver (PAAS.US)$up nearly 4%,$First Majestic Silver (AG.US)$rose more than 2%.

As of press time, the majority of U.S. gold and silver stocks had risen.$Blue Gold (BGL.US)$up more than 16%,$U.S. Gold Corp (USAU.US)$Surging over 7%,$Pan American Silver (PAAS.US)$up nearly 4%,$First Majestic Silver (AG.US)$rose more than 2%.

"The world is hedging against ongoing uncertainty," said Rhona O’Connell, an analyst at StoneX. "During frenzied times, gold retains its role as the ultimate safe-haven asset."

US President Trump's threat to impose tariffs on European allies if they refused his demand for control over Greenland led to a sharp sell-off in US stocks this week, followed by a sudden reversal on Wednesday that drove a market rebound.

However, the dollar struggled to recover its losses, falling more than 1% this week, while gold surged over 7%, marking its largest weekly gain since the early days of the Covid-19 pandemic in 2020.

Before Trump issued tariff threats over Greenland, the US forcibly took control of Venezuelan President Maduro, and the Department of Justice launched a criminal investigation into Federal Reserve Chair Powell.

Seema Shah, Chief Global Strategist at Principal Asset Management, stated that these events have caused some shifts in investor sentiment toward the dollar.

"Amid a series of dramatic events, there has been some collateral damage offstage," she said. "This could amplify arguments for diversifying away from US assets."

The Greenland crisis has reignited concerns about political risks associated with US assets, which have long served as a haven for global capital.

Last year, such risks contributed to a 9% decline in the dollar, its steepest drop since 2017.

Investors describe the threat by the United States to its NATO allies as further 'undermining' the institutional credibility of this world-dominant asset market, a concern that intertwines with apprehensions over the White House's attacks on the Federal Reserve.

Earlier this week, U.S. stocks, bonds, and the dollar all fell in unison, echoing the 'sell America' trade triggered by Trump's tariff storm in April last year.

Another long-term safe haven in the foreign exchange market, the Swiss franc, rose 1.6% against the dollar this week, marking its best performance since June of last year. The euro climbed 1.2% against the dollar, breaking above the 1.17 level.

This policy credibility, or at least policy reliability, has somewhat diminished," said Shah of Principal. "I believe forecasts for a weakening dollar may have been reinforced.

Wall Street had anticipated further dollar softening this year as the Federal Reserve continues to cut interest rates, while other major central banks are expected to remain on hold. Additionally, global investors continue hedging their U.S. asset holdings to protect against dollar volatility, an activity that mechanically depresses the dollar's value.

However, Peter Schaffrik, Global Macro Strategist at RBC Capital Markets, noted that the uncertainty generated by Trump's threat against Greenland has provided investors with another reason to hedge their dollar exposure.

What we are seeing now is precisely why there is demand for such hedging because these things can happen suddenly," Schaffrik said. "Who can guarantee that the situation won't reverse just as abruptly tomorrow?

Editor/Melody